Florida Wage Calculator

How Income Taxes Are Calculated. First we calculate your adjusted gross income.

Florida Paycheck Calculator Smartasset

Florida Paycheck Calculator Smartasset

Simply enter wage and W-4 information for each employee.

Florida wage calculator. This marginal tax rate means that your immediate additional income will be taxed at this rate. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family. Use it to calculate your net pay by inputting up to six hourly wage rates and any applicable federal state and local tax information.

The assumption is the sole provider is working full-time 2080 hours per year. If you make 55000 a year living in the region of Florida USA you will be taxed 9370. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Florida.

Obligors net income is lower than 80000 per month as well as high net income situations combined monthly net income greater than 1000000 per month and the Florida Child Support Calculator on this site was not built to take those special circumstances into consideration. This free easy to use payroll calculator will calculate your take home pay. The law states that whichever is the higher applies to employers in that state.

Check out our new page Tax Change to find out how federal or state tax changes affect your take home pay. Living Wage Calculation for Orange County Florida. Therefore the number you.

Luckily our Florida payroll calculator is here to. Enter the percentage from section 2 b 1 of the Wage Garnishment Order may not exceed 15. Your household income location filing status and number of personal exemptions.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Calculate your Florida net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Florida paycheck calculator. The living wage shown is the hourly rate that an individual in a household must earn to support his or herself and their family.

This free Florida hourly payroll calculator is fast easy to use and constantly updated with the latest tax information. Enter any overtime hours you worked during the wage period you are referencing to. Supports hourly salary income and multiple pay frequencies.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculates Federal FICA Medicare and withholding taxes for all 50 states. If the percentage is 15 enter15 as a decimal.

Federal labor law requires overtime hours be paid at 15 times the normal hourly rate. That means that your net pay will be 45631 per year or 3803 per month. Using our Florida Salary Tax Calculator To use our Florida Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

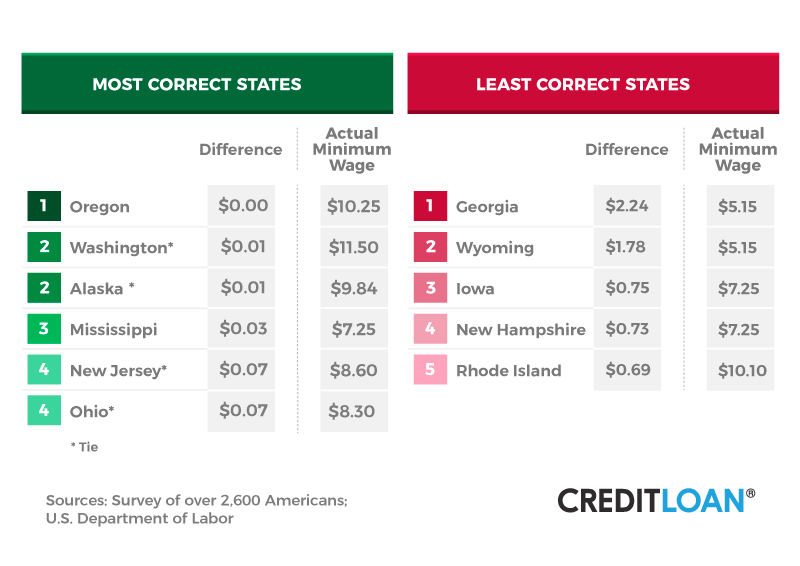

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Florida Salary Calculator uses Florida as default selecting an. The federal minimum wage is 725 per hour and the Florida state minimum wage is 1000 per hour. Living Wage Calculation for Miami-Dade County Florida.

Our calculator will figure out your gross pay net pay and deductions for both Florida and Federal taxes. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. While a 0 state income tax is saving you from some calculations you are still responsible for implementing federal payroll taxes.

Florida Overtime Wage Calculator. The tool provides information for individuals and households with one or. The tool provides information for individuals and households with one.

There are five states that do not. Our income tax calculator calculates your federal state and local taxes based on several key inputs. The assumption is the sole provider is working full-time 2080 hours per year.

Also we separately calculate the federal income taxes you will owe in the 2019 - 2020 filing season based on the Trump Tax Plan. Please note that special circumstances exist for low net income situations ie. In Florida overtime hours are any hours over 40 worked in a single week.

W4 Employee Withholding Certificate The IRS has changed the withholding. See Florida tax rates. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you.

This calculator can help you determine compensation or wage replacement benefits that may be due andor owed to you as the result of a work-related injury or occupational disease. This Florida hourly paycheck calculator is perfect for those who are paid on an hourly basis. Your average tax rate is 170 and your marginal tax rate is 297.

Enter your salary or wages then choose the frequency at which you are paid. Overview of Florida Taxes Florida has no state income tax which makes it a popular state for retirees and tax-averse workers. Florida is one of the states that has a minimum wage rule and ensures that their employers pay it.

Florida Paycheck Calculator Smartasset

Florida Paycheck Calculator Smartasset

Florida Restaurant And Lodging Association Launches Wage Calculator Revealing How A 15 Minimum Wage Would Impact Businesses The Capitolist

Florida Restaurant And Lodging Association Launches Wage Calculator Revealing How A 15 Minimum Wage Would Impact Businesses The Capitolist

Esmart Paycheck Calculator Free Payroll Tax Calculator 2021

Esmart Paycheck Calculator Free Payroll Tax Calculator 2021

Gauging The Minimum Wage For Florida And The Nation Press Release Florida Trend

Gauging The Minimum Wage For Florida And The Nation Press Release Florida Trend

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Free Online Paycheck Calculator Calculate Take Home Pay 2021

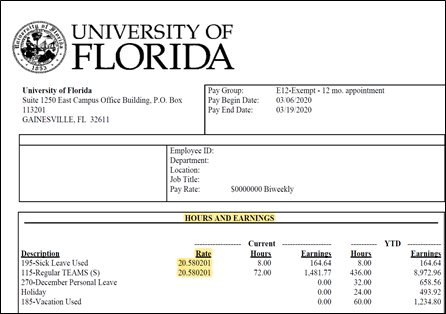

Efmlea Single Day Efm Calculator Uf Human Resources

Efmlea Single Day Efm Calculator Uf Human Resources

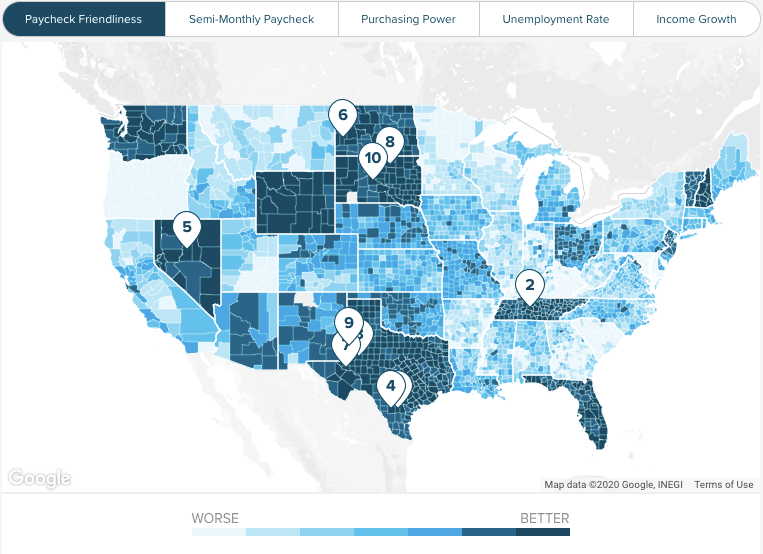

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

How To Do State Of Florida Payroll In 5 Steps

How To Do State Of Florida Payroll In 5 Steps

Paycheck Calculator Take Home Pay Calculator

Paycheck Calculator Take Home Pay Calculator

Florida Paycheck Calculator Smartasset

Florida Paycheck Calculator Smartasset

Free Florida Payroll Calculator 2021 Fl Tax Rates Onpay

Esmart Paycheck Calculator Free Payroll Tax Calculator 2021

Esmart Paycheck Calculator Free Payroll Tax Calculator 2021

Employer Payroll Tax Calculator Gusto

Comments

Post a Comment