If I Pay My Credit Card Before Due Date

You can also make more than one credit card payment each month as long as the minimum payment is made on or before the payment due date. You can make your credit card payment before the due date with no penalty.

What Happens If You Only Pay The Minimum On Your Credit Card

What Happens If You Only Pay The Minimum On Your Credit Card

You can use the card if it has a previous balance on it until the balance reaches the cards credit limit.

:max_bytes(150000):strip_icc()/how-long-does-it-take-a-credit-card-payment-to-post-960266-final-5b4fa00bc9e77c0037431490.png)

If i pay my credit card before due date. This is especially true when you consider that the typical statement period is about 30 days long and your grace period the time between statement closing and the payment due date can be 21 to 25 additional days. At a minimum you should pay your credit card bill before its statement due date. For instance one of my credit cards sends me my statement on the 10th of each month but my payment is.

Otherwise the payment could be applied during the wrong billing cycle. Excess amount will be adjusted in next month bill. For example if you get paid on the 10th you might change your due date to the 14th or 15th of the month rather than the 1st.

Should I pay off my credit card in full before the due date to improve my credit score. Your credit card bills due date simply signifies that a billing cycle has ended and its time to pay up. There are some companies however that allow their customers to make payments up to midnight on the said due date.

When you use a credit card for your purchases you earn the same amount of points miles or cash-back on your spending whether you pay your balance in full before the statement closes or not. If you anticipate making a large purchase you can quickly use up your line of credit before a payment is even due. Lets say you put your 1000 monthly daycare bill on your credit card bill today then set up online bill-pay to send your card 1000 tomorrow.

The due date is not necessarily when your current balance will be reported to the credit. For instance if you make a large purchase or find yourself carrying a. You can pay your credit card bill as late as 5 pm.

Using your credit card today should be fine. You should always pay your credit card bill by the due date but there are some situations where its better to pay sooner. But you can pay your bill early and unlike with your Netflix subscription your electric bill or your rent paying your.

Your credit card statement comes with a due date just like any other bill. Paying a credit card after this due date can result in hefty late fees and depending on the credit card an increased interest rate. It prevents you from being late and suffering the negative consequences of extra fees penalty interest charges and having the negative history appear on your consumer report and hurting your score.

On your due date if your credit card issuer allows expedited payments. By the way even if the payment due date is the 6th the cycle probably ended sometime in the previous month. Be aware that card issuers look at the day it was received not postmarked.

The payment is due 2-3 weeks after the end of the billing cycle. Your credit card payment will be due on the same date every month. Paying Credit Card Bills Early Paying your credit card early before the statement due date is generally a good thing.

Yah and had done that before. However if that date is inconvenient you can have your credit card issuer change your payment due date. Keep in mind that in most cases credit card issuers require their clients to make payments before 5 PM EST on the specified due date.

If you have an account with the bank you can try asking for reverting back to account. Be careful that you dont make the payment too early. So even if you mail a payment before the due date if it gets delayed in the mail it will still be considered late.

If you pay your balance before the end of the month your credit card will report a lower number to the credit bureaus and your utilization ratio will stay low improving your credit score. If youre not in a financial position to pay your bills early dont worry. Miss this and youll deal with late fees and penalties.

Most banks charge somewhere between 25. Your credit card issuers may extend the cutoff time past 5 pm but you should confirm before waiting that long to make your payment on the due date. The answer to that question is yes it is better to pay off your credit cards before the statement cycle ends because you are absolutely correct that that zero balance is what will ultimately get reported to the credit.

What If We Pay The Minimum Payment Of A Credit Card Quora

:max_bytes(150000):strip_icc()/how-long-does-it-take-a-credit-card-payment-to-post-960266-final-5b4fa00bc9e77c0037431490.png) How Long Does It Take A Credit Card Payment To Post

How Long Does It Take A Credit Card Payment To Post

Credit Card Minimum Payment Calculator

Credit Card Minimum Payment Calculator

If I Pay My Credit Card Early Can I Use It Again

If I Pay My Credit Card Early Can I Use It Again

/GettyImages-185264444-56f21be45f9b5867a1c79aa0.jpg) When Is My Credit Card Bill Due

When Is My Credit Card Bill Due

Should You Pay Off Your Credit Card Early Nextadvisor With Time

Should You Pay Off Your Credit Card Early Nextadvisor With Time

How To Change Your Credit Card Due Date Credit Card Insider

How To Change Your Credit Card Due Date Credit Card Insider

Can Merchant Refund Be Considered As A Form Of Partial Payment For A Credit Card Bill Quora

Can Merchant Refund Be Considered As A Form Of Partial Payment For A Credit Card Bill Quora

How To Change Your Credit Card Due Date Credit Card Insider

How To Change Your Credit Card Due Date Credit Card Insider

Reader Tip Pay Your Credit Card Bills Before They Re Due Credit Card Management Credit Card Consolidation Credit Card

Reader Tip Pay Your Credit Card Bills Before They Re Due Credit Card Management Credit Card Consolidation Credit Card

What Happens If I Pay My Credit Card Early Experian

What Happens If I Pay My Credit Card Early Experian

:max_bytes(150000):strip_icc()/dotdash_Final_What_Happens_When_Your_Credit_Card_Expires_May_2020-01-20f6cb63bda2417fbdf4487ff3e0386a.jpg) What Happens When Your Credit Card Expires

What Happens When Your Credit Card Expires

How Paying A Credit Card Statements Work Credit Card Insider

How Paying A Credit Card Statements Work Credit Card Insider

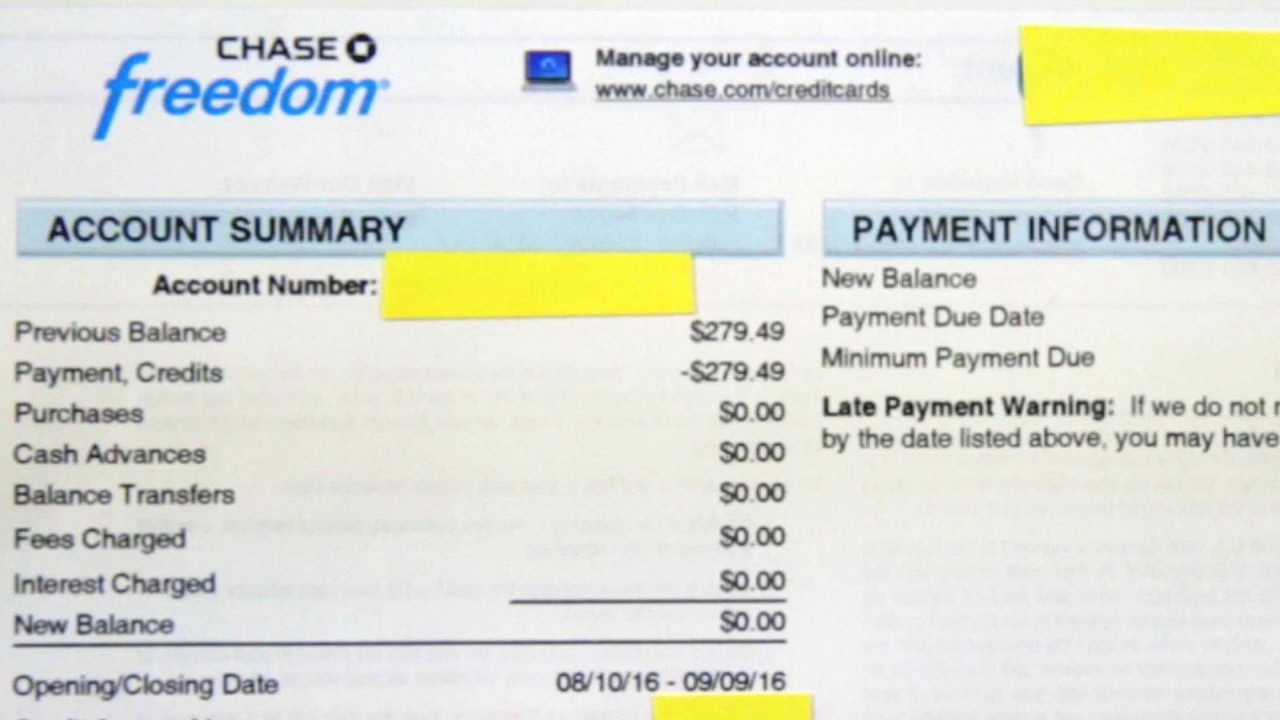

Credit Card Statement Closing Date Vs Due Date Beatthebush Youtube

Credit Card Statement Closing Date Vs Due Date Beatthebush Youtube

Comments

Post a Comment