Conventional Jumbo Loan

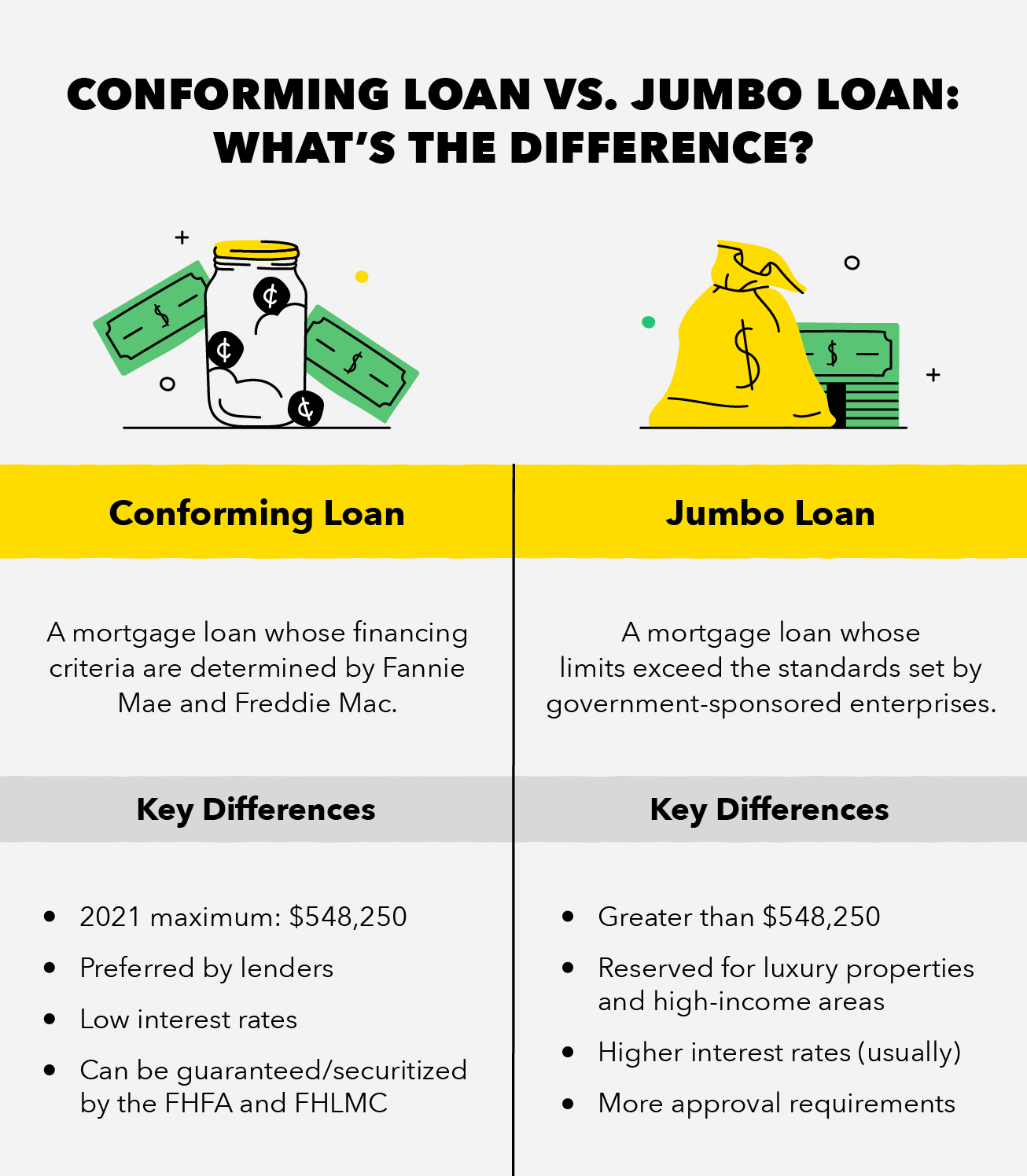

The main difference is that a conventional loan is for a borrower who puts a down payment of 20 while a jumbo loan is a specialty loan for those borrowers who are looking to purchase an expensive luxury property. Anything over that limit is considered a jumbo loan.

Jumbo Vs Conventional Loan Ally

Jumbo Vs Conventional Loan Ally

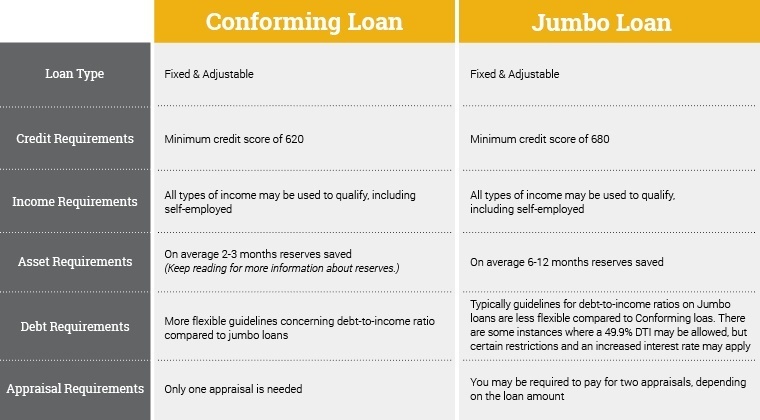

Jumbo loans typically require a minimum credit score of 660 or 680 while the minimum score is generally only 620 for a conforming loan.

:max_bytes(150000):strip_icc()/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

Conventional jumbo loan. NerdWallet March 31 2021 Many or all of the. So if your loan amount is 548250 or higher your home loan is considered jumbo. Jumbo loans are for homes with prices that exceed the conforming loan limit.

In short conventional mortgages are backed by Fannie Mae Freddie Mac whereas Jumbo loans are not. What is a jumbo loan. A jumbo loan also known as a jumbo mortgage is a type of financing that exceeds the limits set by the Federal Housing Finance Agency FHFA.

These mortgages are riskier than conventional or government-backed mortgages because they dont have insurance. Its not uncommon for lenders to expect a minimum of 20 down payment for jumbo loans. There may be instances where you can choose to either go with a jumbo loan or a conventional loan and then it will come down to which loan type has a better interest rate available.

A jumbo loan is a mortgage used to finance properties that are too expensive for a conventional conforming loan. Jumbo loans typically require a 10 down payment or greater while conforming loans may require only a 3 down payment. Well help you choose from some of the best jumbo loan lenders of 2021.

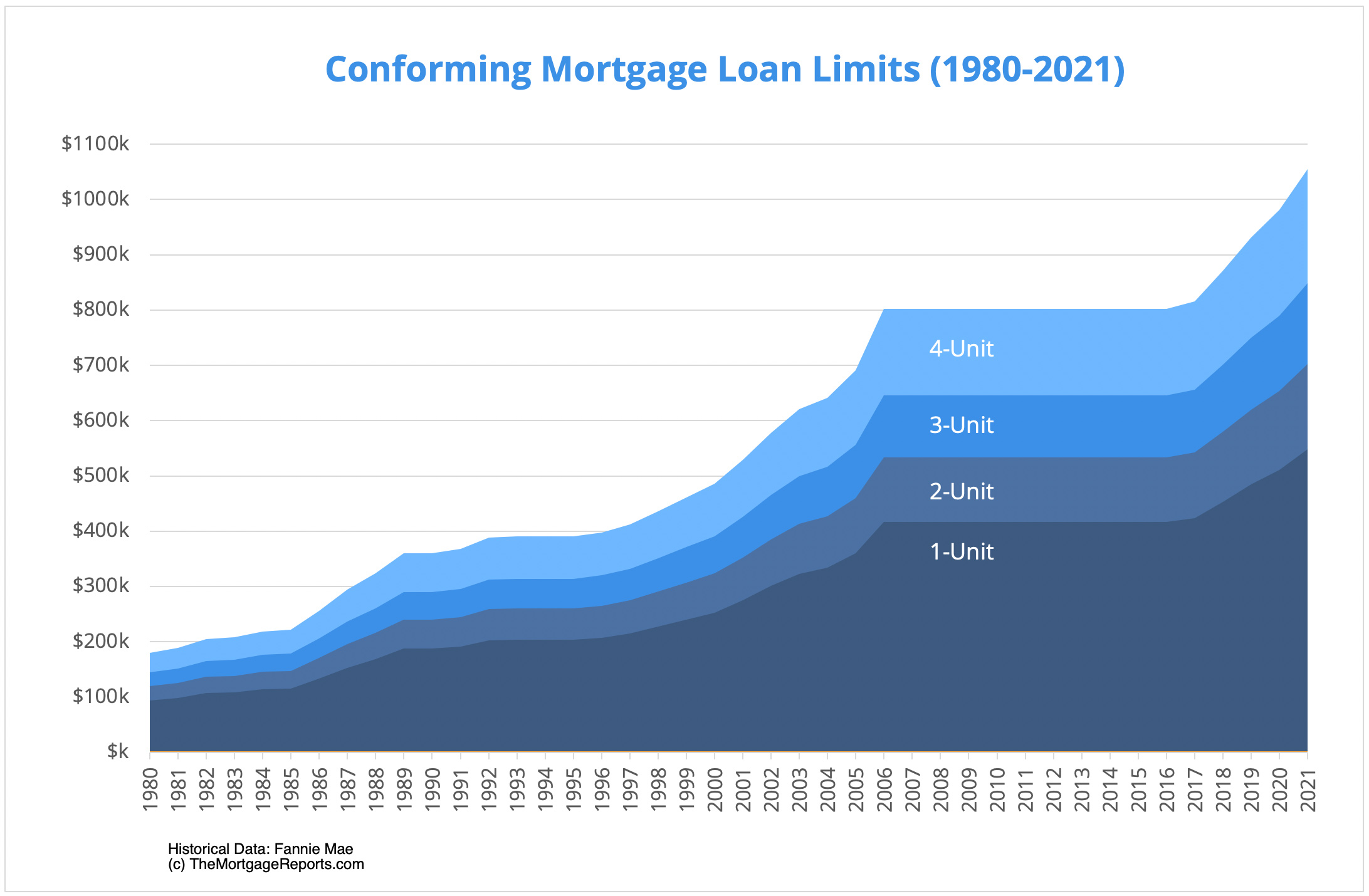

Typically this is just a matter of math. This limit which can change annually is currently 548250 for a one-unit property in the contiguous United States. Jump to jumbo loan topics.

The 51 arm jumbo mortgage rate is 3390 with an. Conventional loans allow for a smaller down payment while jumbo loans tend to require higher down payments. You may need a higher income to qualify for a jumbo loan.

From Wikipedia the free encyclopedia Redirected from Jumbo loan In the United States a jumbo mortgage is a mortgage loan that may have high credit quality but is in an amount above conventional conforming loan limits. Jumbo loans are nothing more than larger mortgage loans. Unlike conventional mortgages a jumbo loan is not.

These jumbo loans are sizes of 500000 or more that an individual or couple are borrowing to finance a luxury property or homes in a highly competitive local real estate market. Jumbo loans are large home loans that are higher than the conforming limits set by Fannie Mae and Freddie Mac. You can use a standard jumbo loan to buy many types of properties though requirements.

Since 2010 we have stepped up by offering. Qualifying for a jumbo loan. A jumbo loan is any single loan amount over the conforming loan limit set by the Federal Housing Finance Agency.

You need enough income to repay the loan amount and jumbo loans are larger. Loan limits in most parts of the country are usually in the 400000-600000 range. What is a Jumbo Loan.

The maximum amount for a conforming loan is 548250 in most. This means that if you default on a jumbo loan the bank has to foot the bill. Credit score The minimum credit score required for a jumbo loan depends on the mortgage lender but is usually at least 700.

The average interest rate on a jumbo loan is typically higher than that of a conventional conforming loan due to the higher risk associated with the larger loan size. The average 15-year fixed jumbo mortgage rate is 2400 with an APR of 2460. The government has imposed lending limits for most home loans making it impossible to buy a more expensive home through conventional mortgage loans.

The 71 ARM jumbo mortgage rate is 3250 with an APR of 3770. Jumbo loans can exceed 1000000 but they are much harder to obtain than conventional loans. Jumbo loans are available to both purchase and refinance customers looking to obtain financing for loan amounts that exceed 625000 as set by the agencies of Fannie Mae and Freddie Mac.

Often jumbo loans require larger down payments than conventional loans.

Jumbo Mortgages Definition Rates And Loan Limits The Truth About Mortgage

Jumbo Mortgages Definition Rates And Loan Limits The Truth About Mortgage

What Is A Conventional Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Conventional Mortgage Loan Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Jumbo Vs Conventional Loans Infographic New American Funding

Jumbo Vs Conventional Loans Infographic New American Funding

Conforming Mortgage Loans Conforming Loan Limits The Truth About Mortgage

Conforming Mortgage Loans Conforming Loan Limits The Truth About Mortgage

Why Are Jumbo Loans Cheaper Than Conforming Loans

Why Are Jumbo Loans Cheaper Than Conforming Loans

2021 Conforming Loan Limits Range From 548k To Over 1 Million My Select Life By The Select Group

2021 Conforming Loan Limits Range From 548k To Over 1 Million My Select Life By The Select Group

What Is A Conventional Mortgage Loan The Truth About Mortgage

What Is A Conventional Mortgage Loan The Truth About Mortgage

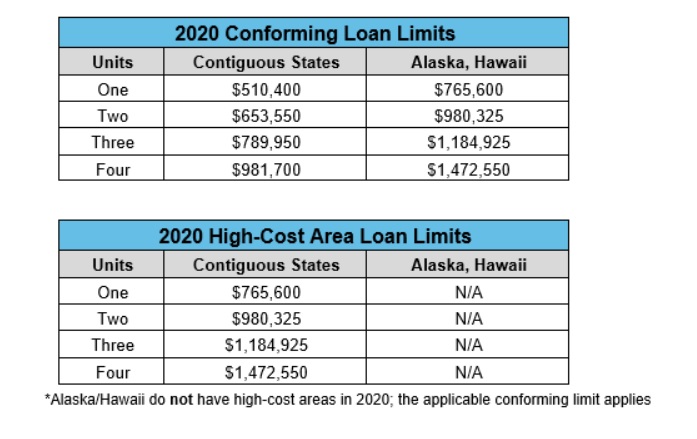

Conventional Loan Limits For 2020 Remn Wholesale A Division Of Homebridge Financial Services

Conventional Loan Limits For 2020 Remn Wholesale A Division Of Homebridge Financial Services

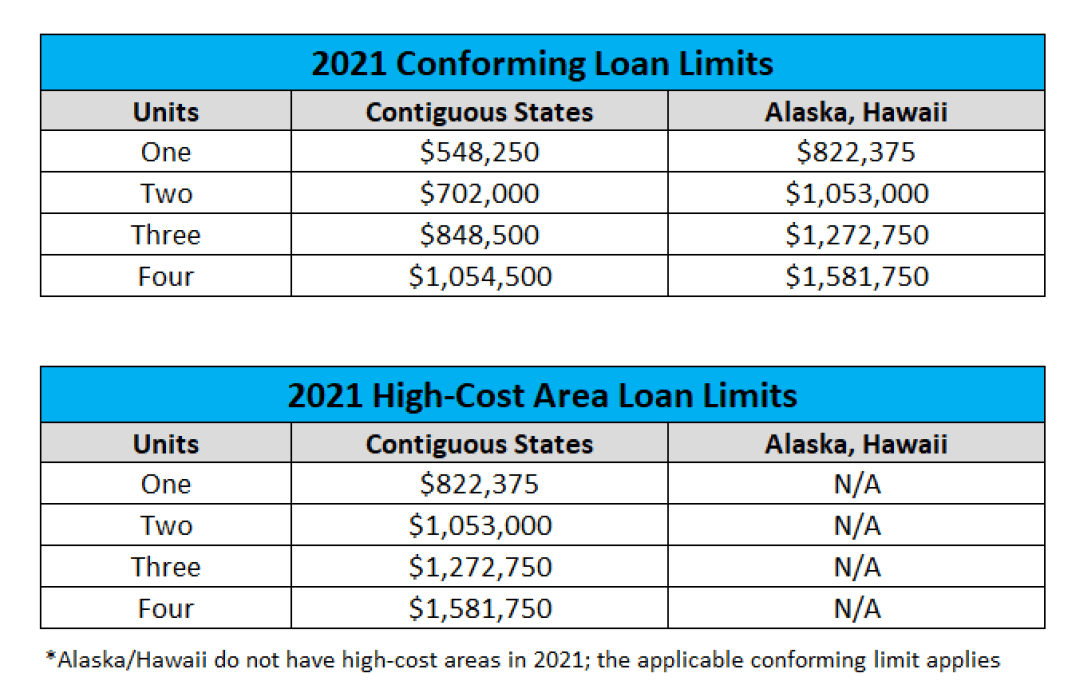

Conventional Loan Limits For 2021 Remn Wholesale A Division Of Homebridge Financial Services

Conventional Loan Limits For 2021 Remn Wholesale A Division Of Homebridge Financial Services

What Is A Jumbo Loan Finance Your Property In A Competitive Market

What Is A Jumbo Loan Finance Your Property In A Competitive Market

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

/dotdash_Final_Jumbo_Loan_May_2020-01-d552693b65b74099bf1c6cd4d300cc5a.jpg)

Comments

Post a Comment