Family Loan Rates

The list below presents the revenue rulings containing these AFRs in reverse chronological order starting with January 2000. Todays mortgage rates in California are 2891 for a 30-year fixed 2107 for a 15-year fixed and 3185 for a 51 adjustable-rate mortgage ARM.

Reverse Mortgages Family Style The New York Times

Reverse Mortgages Family Style The New York Times

6 rows FNMA Standard Multifamily Rates - Small Mortgage Program.

Family loan rates. The actual fees costs and monthly payment on your specific loan transaction may be higher or lower than those quoted based on your information which may be determined after you apply. Compare MA mortgage rates by loan type. Family Trust Visa Credit Cards Learn More.

How mortgage interest rates have shifted over the past week 30-year fixed mortgage rate. Loan data is for informational purposes only and is based on owner occupied single-family homes only. These rates known as Applicable Federal Rates or AFRs are regularly published as revenue rulings.

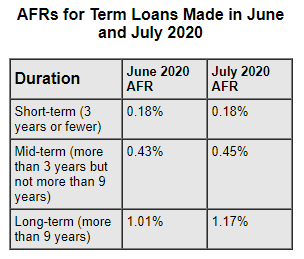

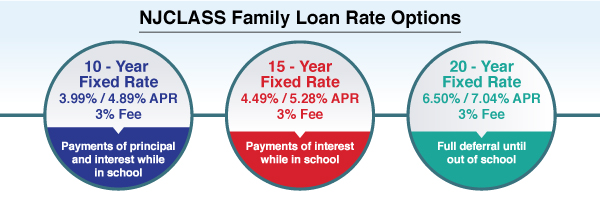

The minimum interest rate varies based on whether a loan is a short term three years or less midterm over three years but not over nine years or long term over nine years loan. 121 months at 525 APR equals payments of 999 per 1000 borrowed. Personal Loan Payment examples.

Enter a term in the Find Box. Rates subject to credit score loan term collateral ageMileage. 3 Long-term rates for loans with a repayment term greater than nine years.

2 Mid-term rates for loans with a repayment term between three and nine years. Up to 60 months. Variable Rate Home Equity Annual Percentage Rate APR may increase after consummation of the loan.

307 the same as last week 15-year fixed mortgage rate. The current long-term AFR a loan of nine years or longer is 215 as of March 2020 while the current national average for a 30-year mortgage is around 4. There are three AFR tiers based on the repayment term of a family loan.

Boat Motorhome Travel Trailer Camper. Term Fixed Rate Adjustable Rate. Since the loan is coming from a family member instead of a for-profit corporation you may get a loan at a much lower interest rate than what a.

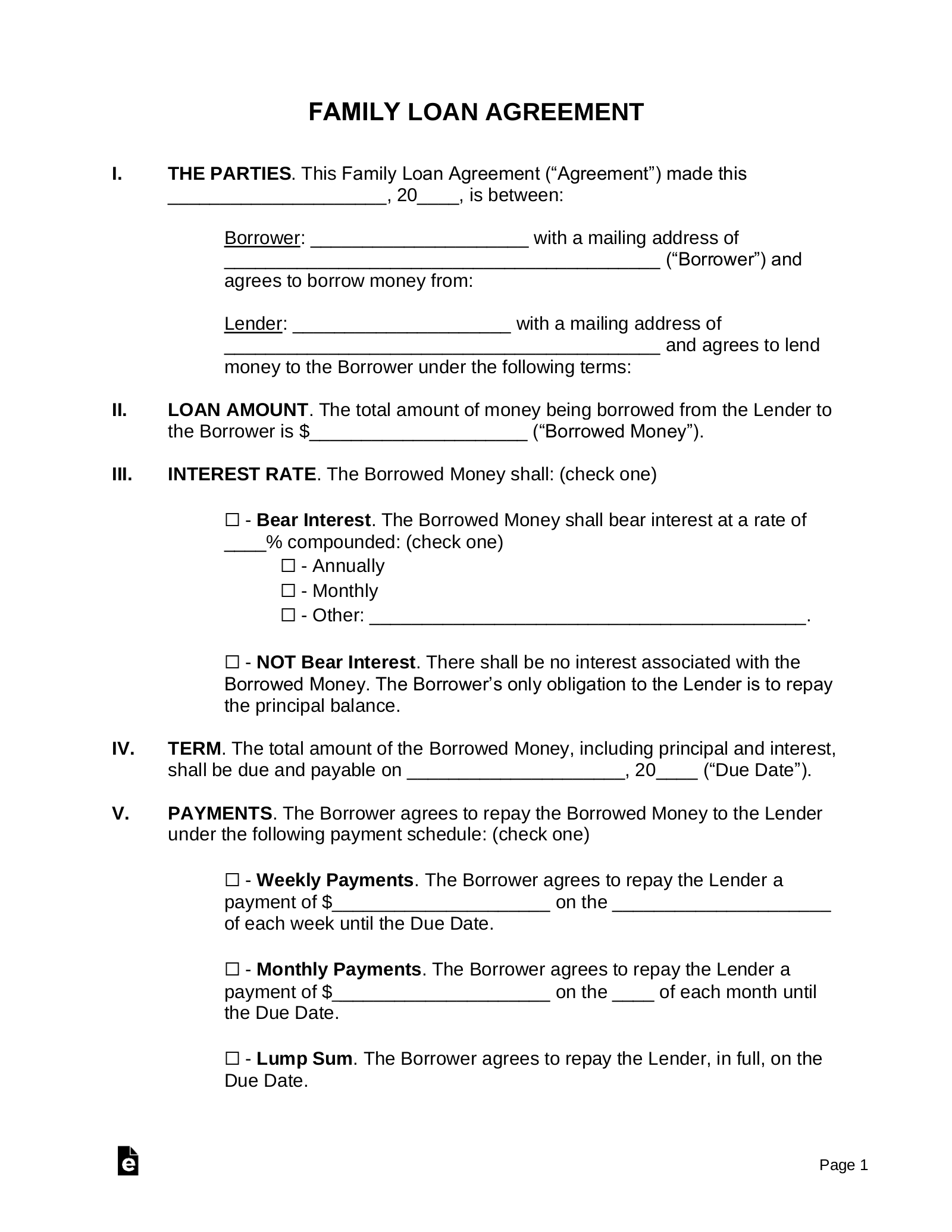

Calculate the planned loan at various interest rates and different repayment periods to determine a monthly payment that the buyer can actually afford. If the selected rate is too high the buyer might default creating unnecessary tension within a close network of friends and family. Market interest rates generally have to be applied to what you lend or borrow for your family loan to be treated as a loan.

Compare week-over-week changes to mortgage rates and APRs in Massachusetts. Check out our other mortgage and refinance tools. Each month the IRS provides various prescribed rates for federal income tax purposes.

2 APY Annual Percentage Yield. As of January 2021 the annual applicable federal rate for a short-term loan was 014. 1 Short-term rates for loans with a repayment term up to three years.

120 months at 449 APR equals payments of 988 per 1000 borrowed. 24 monthly payments of 11107 for every 2500 borrowed at 624 APR. The APR includes both the interest rate and lender fees for a more realistic value comparison.

Rates subject to credit score loan term collateral ageMileage. Ask your Loan Consultant about additional terms and rates. As with a traditional loan an intra-family loan requires an adequate interest rate be charged for the use of the funds to avoid adverse income or gift tax consequences.

If you make an interest-free or a reduced-interest loan that is below the market interest rate you are making a gift in the eyes of Uncle Sam. 60 months at 349 APR equal payments of 1819 per 1000 borrowed. Fremont Bank offers great multifamily loan rates on commercial real estate loans multifamily loans apartment loans with professionals you can trust.

You make a five-year term loan to your beloved nephew in July of 2020 and charge an interest rate of exactly 045 with annual compounding the AFR for a. Contact us for more information. The table below is updated daily with Massachusetts mortgage rates for the most common types of home loans.

24 monthly payments of 11135 for each 2500 borrowed at 649 APR. Understanding a key element of intra-family loans. National Family Mortgage is the smart way to manage mortgage loans between family members.

Need A Loan Tax Rules Now Let You Borrow From Family At Ultra Low Interest Rates

Need A Loan Tax Rules Now Let You Borrow From Family At Ultra Low Interest Rates

Freddie Mac Single Family Fixed Rate Mortgage Data Description Download Table

Freddie Mac Single Family Fixed Rate Mortgage Data Description Download Table

A Good Time For Making Tax Smart Family Loans Samet Company Pc

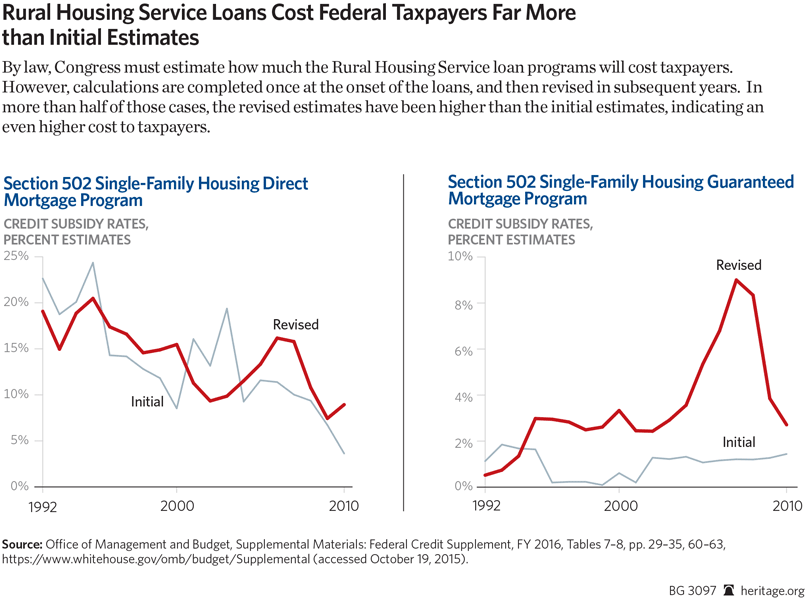

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Usda Home Loans Rural Development Loan Property Mortgage Eligibility Requirements

Intra Family Loans At All Time Low Interest Rates Sandy Cove Advisors

Intra Family Loans At All Time Low Interest Rates Sandy Cove Advisors

Why And How To Charge Interest On Loans To Family Members

Intra Family Mortgage Lending Financial Product Reviews

Reversing Trend Interest Rates On Ad C Loans Decline In 3rd Quarter Eye On Housing

Reversing Trend Interest Rates On Ad C Loans Decline In 3rd Quarter Eye On Housing

Rates On Construction Loans Continue To Drift Downward Eye On Housing

Rates On Construction Loans Continue To Drift Downward Eye On Housing

Nahb Usda Single Family Programs Trends In Loans For New Construction

Nahb Usda Single Family Programs Trends In Loans For New Construction

Wealth Transfer Planning In A Low Interest Rate Environment Geller Advisors

Wealth Transfer Planning In A Low Interest Rate Environment Geller Advisors

Free Family Loan Agreement Template Pdf Word Eforms

Free Family Loan Agreement Template Pdf Word Eforms

Comments

Post a Comment