How To Purchase Bonds

Each time you buy bonds you must meet the minimum investment of 100 pounds or 50 pounds with a per-month purchase. Invest in a variety of bonds with different maturities either by buying a bond fund or buying a half-dozen or more individual bonds.

How To Buy Bonds In India Indianmoney

How To Buy Bonds In India Indianmoney

Buying municipal bonds follows more traditionally with the standards in the bond market overall.

How to purchase bonds. A Step-by-Step Guide - SmartAsset. How To Buy Bonds. The bonds have a stated interest rate of 10 paid semi-annually and the bond matures in 5 years.

To get a hold of a primary bond youll need to have relationships with someone at one of the institutions that manage the primary bond offering. Buying Directly From the US. Department of the Treasury.

You can purchase more bonds in your name the same way you purchase your initial bonds. Build a laddered portfolio. Each rung of your ladder consists.

Assume we purchase 50000 in bonds of ABC Corporation for 45000 cash. Say you have 100000 to invest. This app is called NSE goBID.

Purchasing a primary bond offering is quite trickyits similar to buying stock in an IPO before the start of public trading. As noted above treasury bonds are issued in increments of 100. You can purchase government bonds like US.

Purchase more bonds as needed. You could go with an online do-it-yourself firm or a traditional bank or brokerage firm and depending on which route you choose you would either work with a representative or fly solo to find bonds that satisfy your specific needs. To record purchase of ABC.

Small investors like me and you can buy government bonds in India using a mobile app or a web based app of National Stock Exchange NSE. 1500 Pennsylvania Ave NW. In order to purchase bonds you would first need to open an account with a firm or bank that deals in bonds.

Laddering involves buying a series of bonds with ascending maturities. 5 to 40 year. This is the only way to get paper bonds anymore and youll need to file IRS Form 8888 to gain eligibility.

Holding time less than 1 year. But if youre looking to use your tax refund to purchase bonds the US. You can buy Treasury bonds directly from the US.

Thus most investors buy municipal bonds through brokerage accounts. The issuer also repays the face value of the bond when upon maturity of the term. Treasury or through a bank broker or dealer.

To record the purchase of these bonds we record the amount we actually paid for the bonds we do not use discount or premium accounts. You might build a 10-year ladder by investing 10000 in a bond with a one-year maturity. Buyers can purchase bonds above or below par value to receive a specific yield Yield is calculated by dividing the coupon rate by the price paid for the bond.

Mon-Fri 800am - 500pm. To buy Treasury bonds directly from us you must have an account in TreasuryDirect. Treasury bonds through a broker or directly through Treasury Direct.

Treasury Department will grant you a paper bond. Open An Account By bidding for a bond in TreasuryDirect you. In return the issuer promises to pay a specified rate of interest during the life of the bond.

When you purchase any type of bond government convertible callable etc you are lending money to the issuer which may be a corporation the government a federal agency or any other entity. Treasury Department through a brokerage like Fidelity or Charles Schwab or through mutual fund or exchange-traded fund. You can buy bonds through the US.

Bonds usually can be purchased from a bond broker through full service or discount brokerage channels similar to the way stocks are purchased from. Either of these two apps can be used to buy the following.

How To Buy Bonds Where And How To Purchase And Sell Benzinga

How To Buy Bonds Where And How To Purchase And Sell Benzinga

/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png) What Bonds Are And How They Work

What Bonds Are And How They Work

/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png) Where Can I Buy Government Bonds

Where Can I Buy Government Bonds

How To Buy Government Bonds In India Getmoneyrich

How To Buy Government Bonds In India Getmoneyrich

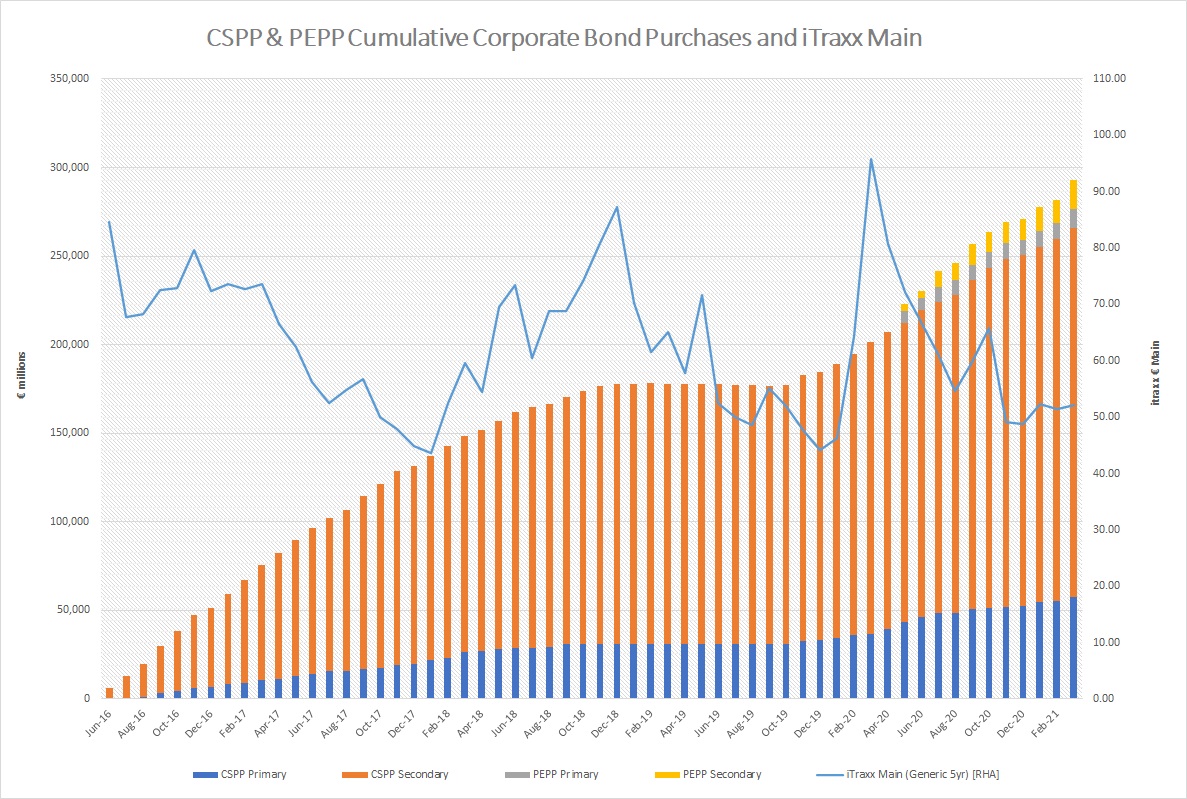

Central Bank Corporate Bond Purchase Programmes

Central Bank Corporate Bond Purchase Programmes

:max_bytes(150000):strip_icc()/what-are-bonds-and-how-do-they-work-3306235_V3-cc55a8d3b82d4d34a991d6cc4fa8a865.png) What Bonds Are And How They Work

What Bonds Are And How They Work

:max_bytes(150000):strip_icc()/WherecanIbuygovernmentbonds1_2-8e2ac360d217459eb54ebea0070eb5b5.png) Where Can I Buy Government Bonds

Where Can I Buy Government Bonds

How To Buy Government Bonds In India Getmoneyrich

How To Buy Government Bonds In India Getmoneyrich

What Are Government Bonds Learn About Bonds

What Are Government Bonds Learn About Bonds

How To Buy Bonds A Step By Step Guide Smartasset

How To Buy Bonds A Step By Step Guide Smartasset

/treasurynotes-bills-and-bonds-3305609-finalv42-fc941b4ff55d4247951067ef742a406b.png) Treasury Bills Notes And Bonds Definition How To Buy

Treasury Bills Notes And Bonds Definition How To Buy

Why You Should Buy Bonds On Your Own Kiplinger

Why You Should Buy Bonds On Your Own Kiplinger

The Ecb Resumes Corporate Bond Purchases Here Is What You Have To Know

The Ecb Resumes Corporate Bond Purchases Here Is What You Have To Know

/dotdash_Final_Bond_Apr_2020-01-63d1901859ed40f5bc7533de1a31e857.jpg)

Comments

Post a Comment