How To Amend Tax Return Online

File using paper form. Do keep in mind that you cannot request an amendment to.

Example John a medical doctor made up the accounts of his practice to 31 March each year.

How to amend tax return online. From there the software will walk you through the process of filing the amendment. The program will proceed with the interview questions for you to complete the amended return. Look under the state summary for the link to amend the return.

Requesting an amendment to your tax return online simply requires you to log in to your CRA My Account and click Change my return. Taxpayers cant file amended returns electronically. Online My Account.

Online for 2018 ended on Oct 15 2019. 2018 and earlier can only be amended with TurboTax using the CDdownload version installed on a PC or Mac computer. Regardless of how you lodged your original tax return you can request an online amendment.

Correction of any error made on form submitted manually or online can be made by writing a letter detailing the mistake made and enclosing documents purchase receipts invoices etc to support your application. A - To amend your State tax return with On-Line Taxes Inc. Request an online amendment.

If youre owed a refund you can arrange payment to your bank account through the same online service. Choose Tax return options. If you filed your return online you can amend your return online too.

There are a couple of options for amending your return going online is the quickest and easiest for you. You can only amend using the desktop software. To file an amended return online.

To amend your tax return all you need to do is log in to Sprintax or create your account. Only tax year 2019 Forms 1040 and 1040-SR returns can be amended electronically. That is a big deal since up to.

The IRS offers tips on how to amend a tax return. Use My Account to make certain changes to your Income Tax and Benefit Return such as. Completing Your Amended Tax Return Online.

For all Tax Years prior to 2020 Prepare Print Sign and Mail-In - see address above - your Tax Amendment by Tax Year as soon as possible. If you have any further questions you may contact our Customer Service for assistance. If you prepared your original tax return using TurboTax log in to your account open the tax return you already filed and click on the link to amend your return.

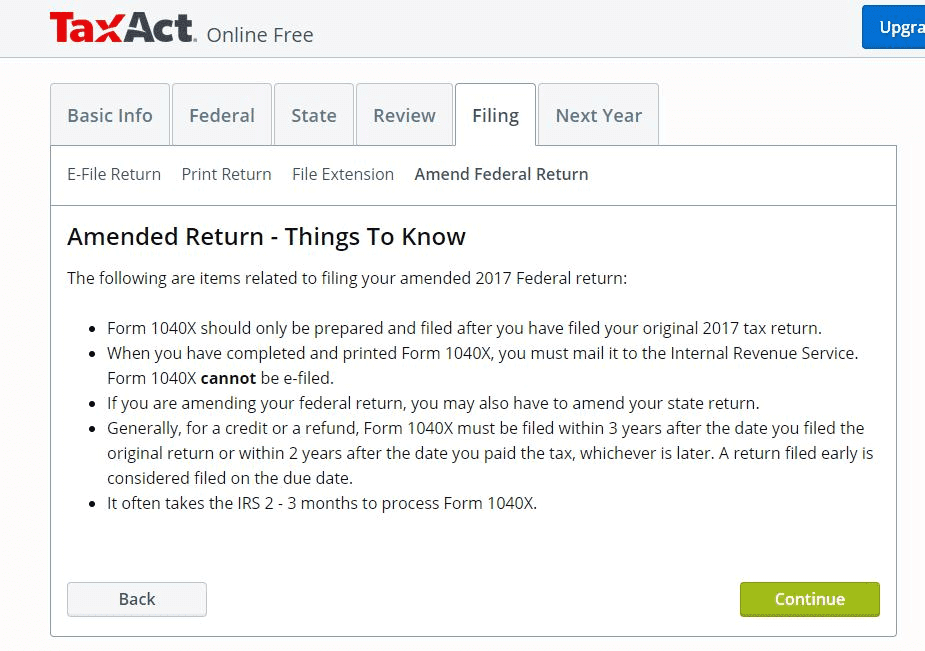

Just make sure to select the box that says I want to correct my 201920182017 tax return. Log into your account and go to that tax year. From within your TaxAct return Online or Desktop click Filing to expand then click Amend Federal Return.

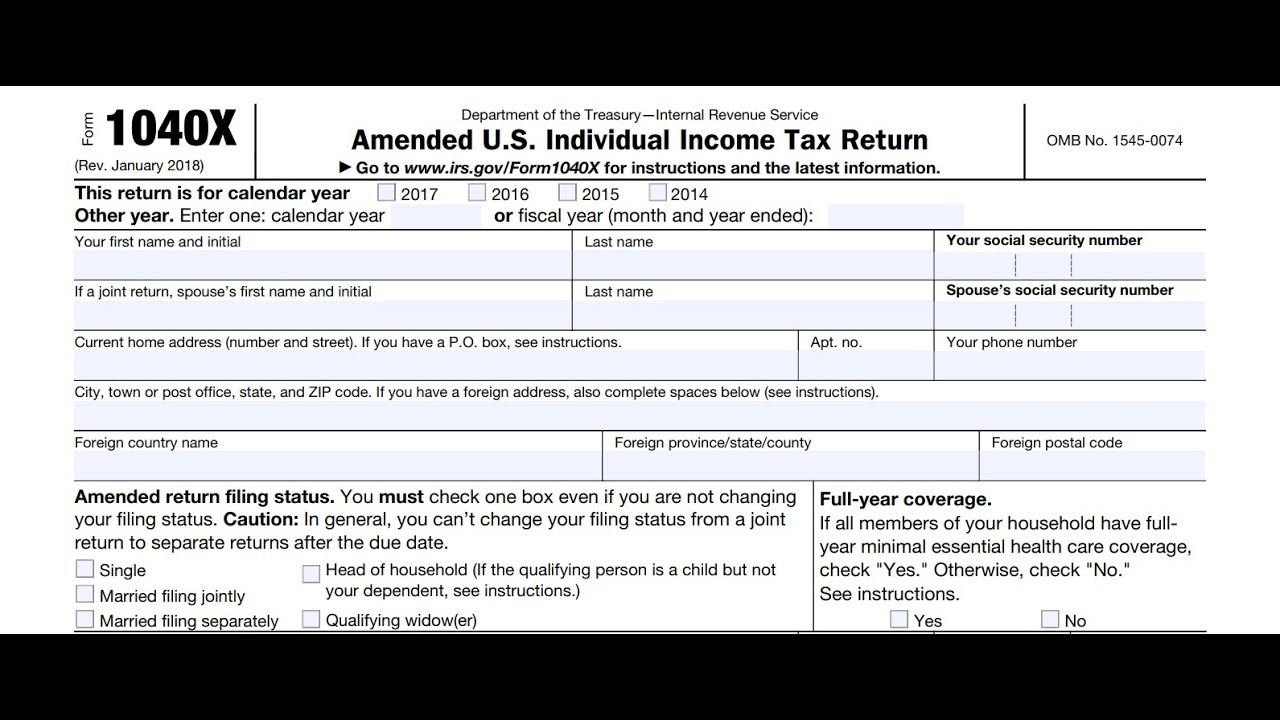

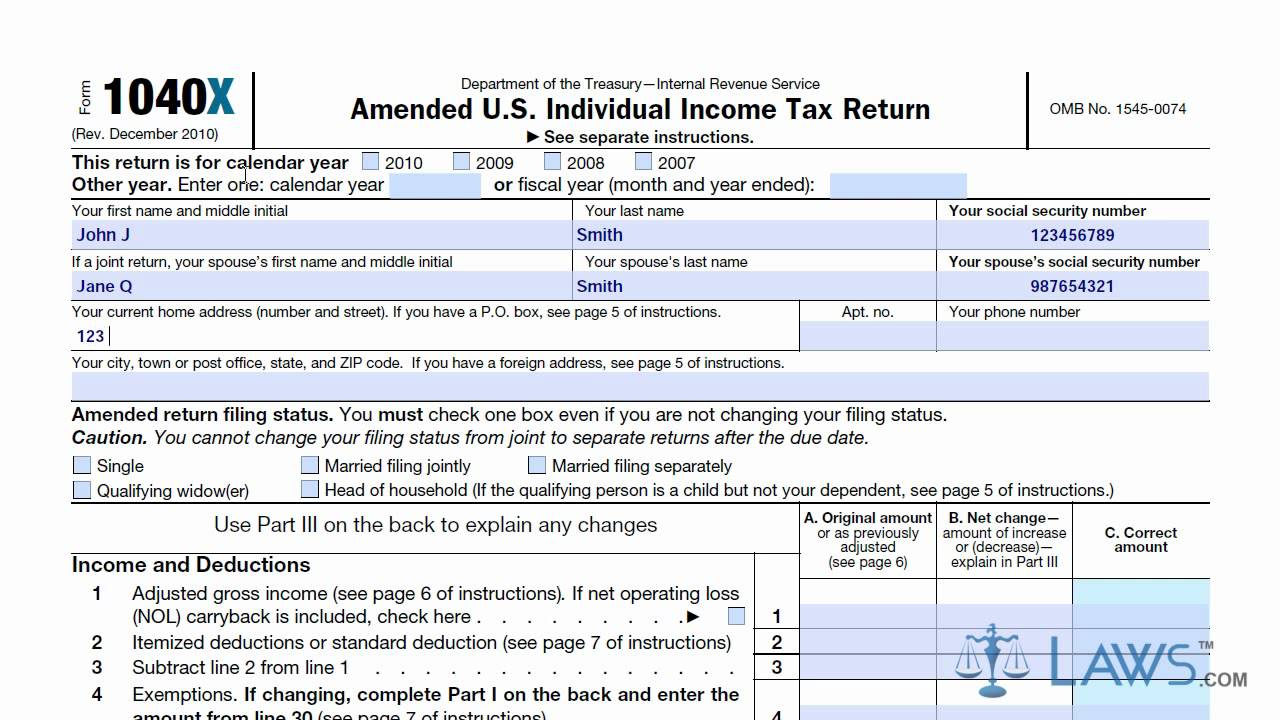

Additionally you must indicate that it is an amended return by checking the box at the top of page 1. For tax years 2016 and forward amended returns can be filed electronically with certain third-party software providers or by mail. Go into the tax return make the corrections and file it again.

For 2015 2016 and 2017 he filed his tax return and calculated his Case II profits based. To amend the IT 1040 or SD 100 you should file a new return reflecting all the proposed changes. Choose the tax year for the return you want to amend.

To do this you need to log into your HMRC online account and select the self-assessment from the home at a glance page. Change my return CMR is a secure My Account service that allows you to make an online adjustment for the 10 previous calendar years. On smaller devices click in the upper left-hand corner then click Filing.

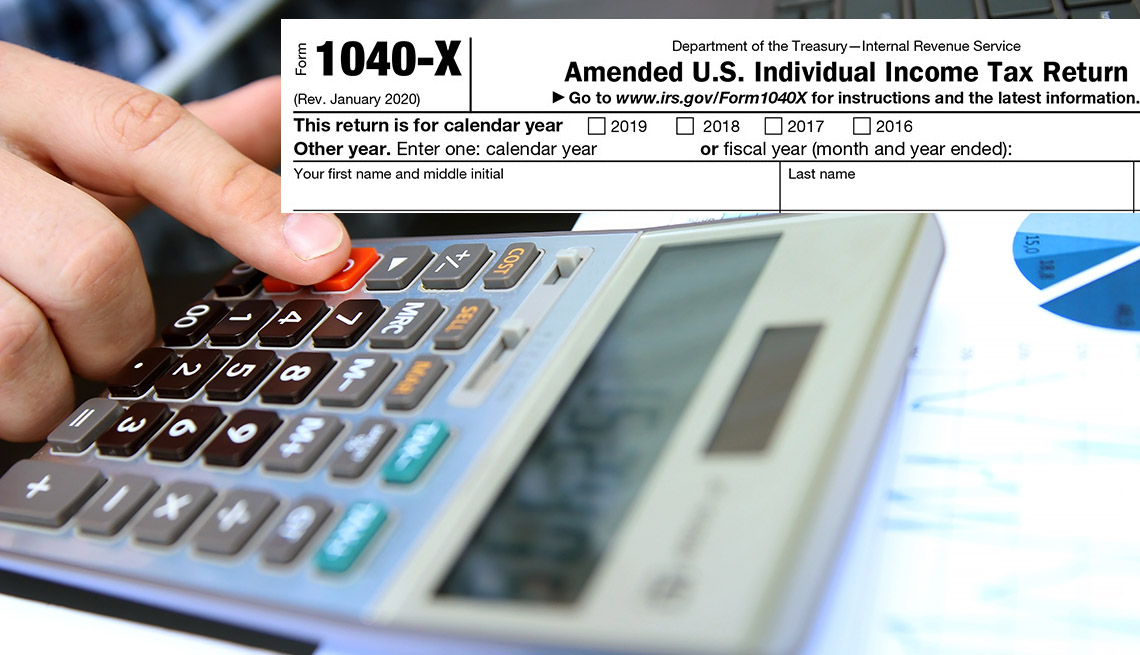

The IRS has announced that this summer for the first time you can amend your tax return file Form 1040-X electronically. You cannot use Change my return to change. 2019 amended Federal returns can either be e-filed or mailed.

This will be visible only after you e-file your original return and its been accepted by the IRS Follow the steps on the screen to amend the return. You can now submit the Form 1040-X Amended US. If you are also amending the federal return that should be completed first.

The letter and supporting documents must be. Mistake in the taxpayers tax return and that claim is submitted to Revenue after 1 January 2014 then the taxpayer must amend the tax return to correct that error or mistake. Online amendments are generally processed within 20 business days.

If you updated your tax return online youll see an amended figure in your online Self Assessment account within three days. Go to the Overview of the HR Block Online product. You will be asked to choose the tax year that you would like to amend.

Individual Income Tax Return electronically using available tax software products. You select the line that needs to be corrected and input the corrected value. Use Form 1040-X Amended US.

Individual Income Tax Return to correct errors to an original tax return the taxpayer has already filed. Choose the option to file an amended return. 2018 and earlier amended returns can only be mailed.

Form 1040 X Now Can Be E Filed But Just For Now To Correct 2019 Return Mistakes Don T Mess With Taxes

Tips For Filing Your Amended Tax Return Updated For 2018

Tips For Filing Your Amended Tax Return Updated For 2018

Send An Amended Tax Return Online

Send An Amended Tax Return Online

Where S My Amended Tax Return Don T Mess With Taxes

Can You Amend Your Self Assessment Tax Return Once It Has Been Filed

Can You Amend Your Self Assessment Tax Return Once It Has Been Filed

Where S My Amended Refund Irs Where S My Amended Return 1040x

Can I Amend My Tax Return Online Electronically

Can I Amend My Tax Return Online Electronically

How To File An Amended Tax Return

How To File An Amended Tax Return

Prepare And File 1040 X Income Tax Return Amendment

Prepare And File 1040 X Income Tax Return Amendment

How To File An Amended Tax Return With The Irs Turbotax Tax Tips Videos

How To File An Amended Tax Return With The Irs Turbotax Tax Tips Videos

Irs Will Allow Taxpayers To File Amended Returns Electronically

Irs Will Allow Taxpayers To File Amended Returns Electronically

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Learn How To Fill The Form 1040x Amended U S Individual Income Tax Return Youtube

Sending An Amended Self Assessment Tax Return Online

:max_bytes(150000):strip_icc()/Screenshot23-9b7ca8ec7adf4e11b37a6eb53f751745.png)

Comments

Post a Comment