Can I Open An Ira For My Child

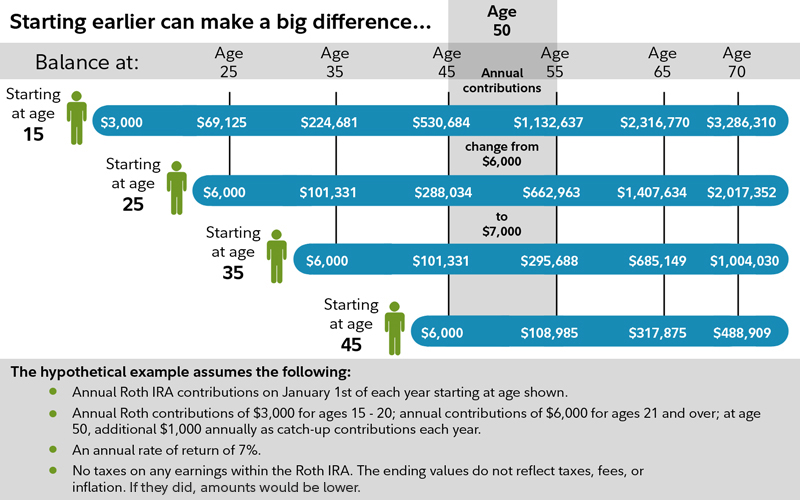

However theres one caveat. The earlier your kids get started saving the greater the opportunity to build a sizeable nest egg.

Why Your Kid Needs A Roth Ira Nerdwallet

Why Your Kid Needs A Roth Ira Nerdwallet

That means that at the age of 18 the child now adult can do with the money whatever they choose.

Can i open an ira for my child. Opening a Roth IRA for your kid can be a great saving option for college and other future expenses. Thankfully you as their parent can open a Custodial Roth IRA on their behalf. But since an IRA is an INDIVIDUAL retirement account he or she would have to open his own account perhaps at Fidelity or Vanguard and make the investment.

Roth IRAs provide the opportunity for tax-free growth. You must be the parent or legal guardian of a child to open an IRA for him. Opening a Roth IRA for your child is a great idea see Why Your Kids Need a Roth IRA to learn more.

Heres an idea for giving your adult children gifts that you might not have thought of. If your adult child is eligible but not contributing because of lack of funds or just not concerned about saving for retirement you can give him or her the money each year. In addition to helping them get a head start on retirement saving a.

The only drawback for opening a Roth IRA in the name of a minor is that the ownership of the account passes on to the child when he or she attains maturity. My child doesnt work but gets allowance. Theres an annual maximum contribution of 5500 per child.

However as long as your kid meets eligibility requirements you can open one on their behalf and even make contributions. A Roth IRA for Kids can be opened and receive contributions for a minor with earned income for the year. Youll also have to provide the name date of birth and Social Security number for at least one beneficiary.

That income can include money earned from self-employment work babysitting shoveling snow walking dogs mowing lawns for example or formal employment. Can I Invest in an IRA for My Child if I Make Too Much Money. As the custodian you the adult control the assets in the IRA making all investment decisions until your child reaches majority age at which point they are turned over to them.

The traditional and the Roth. It involves doing something for your adult children that few. Ill let your imagination take over on what an 18 year would do with a windfall of money.

For example you couldnt open a Custodial IRA account for your. It not only provides security for the next generations of your family but also does so without losing much if any in taxes to Uncle Sam. A Child IRA works in the same way as regular IRA except that there is a custodian overseeing the.

IRA types for kids. The rules say that IRA contributions cannot exceed a minors earnings eg if a minor earns 1000 then only 1000 can be contributed to the account. To open an account you must provide your own name address and contact information as well as the name date of birth and Social Security number of the child.

With a traditional IRA your money goes in tax-free but when you take. Children cannot open Roth IRAs themselves. How to Start an IRA for Children 3.

If your child has earned income there are two options for opening an IRA. You can also give someone a Roth IRA by designating them as your account beneficiary. You can give a child a Roth by establishing an account in their name and helping to fund it.

So say I contribute 1k per year do i ne. But you cant open one unless your child has earned income from a. It is possible to open an individual retirement account IRA for a child.

Theres no lower age limit when it comes to starting an IRA. Because your child is a minor they cant open their own account. How to Open a Savings Account for an Infant Grandchild.

A child must earn their own income in order to open an IRA. However not all brokerages offer Custodial IRA accounts. The Benefits of Opening a Roth IRA For Your Adult Children.

Heres how a Roth IRA for a child works. Opening an IRA -- and particularly a Roth IRA -- for your children or grandchildren could be an extremely wise financial move.

A Roth Ira Can Help Your Child Become A Millionaire Before Retirement The Motley Fool

A Roth Ira Can Help Your Child Become A Millionaire Before Retirement The Motley Fool

Should I Open An Ira For My Child The Motley Fool

Should I Open An Ira For My Child The Motley Fool

Can You Open A Roth Ira For Your Kids The Motley Fool

Can You Open A Roth Ira For Your Kids The Motley Fool

Can I Open A Roth Ira For My Minor Child Ymyw Podcast Youtube

Can I Open A Roth Ira For My Minor Child Ymyw Podcast Youtube

Can I Open A Roth Ira For My Child Greenbush Financial Group

/Opening-a-Roth-IRA-for-Kids-56a090c93df78cafdaa2c714.jpg) Why You Should Open A Roth Ira For Kids

Why You Should Open A Roth Ira For Kids

Roth Ira For Kids Benefits Rules And How To Set One Up

How To Set Up A Roth Ira For Your Child Investing 101 Us News

How To Set Up A Roth Ira For Your Child Investing 101 Us News

/GettyImages-510411161-57714f815f9b585875a9e274.jpg) Can I Open An Ira For My Child

Can I Open An Ira For My Child

/GettyImages-510411161-57714f815f9b585875a9e274.jpg) Can I Open An Ira For My Child

Can I Open An Ira For My Child

/child_with_money-5bfc37e0c9e77c00514735b3.jpg) The Benefits Of Starting An Ira For Your Child

The Benefits Of Starting An Ira For Your Child

Start A Roth Ira For Kids Youtube

Start A Roth Ira For Kids Youtube

Your Children Could Make A Lot Of Money Down The Road If They Do This Marketwatch

Your Children Could Make A Lot Of Money Down The Road If They Do This Marketwatch

Comments

Post a Comment