Max 401k And Ira Contribution 2020

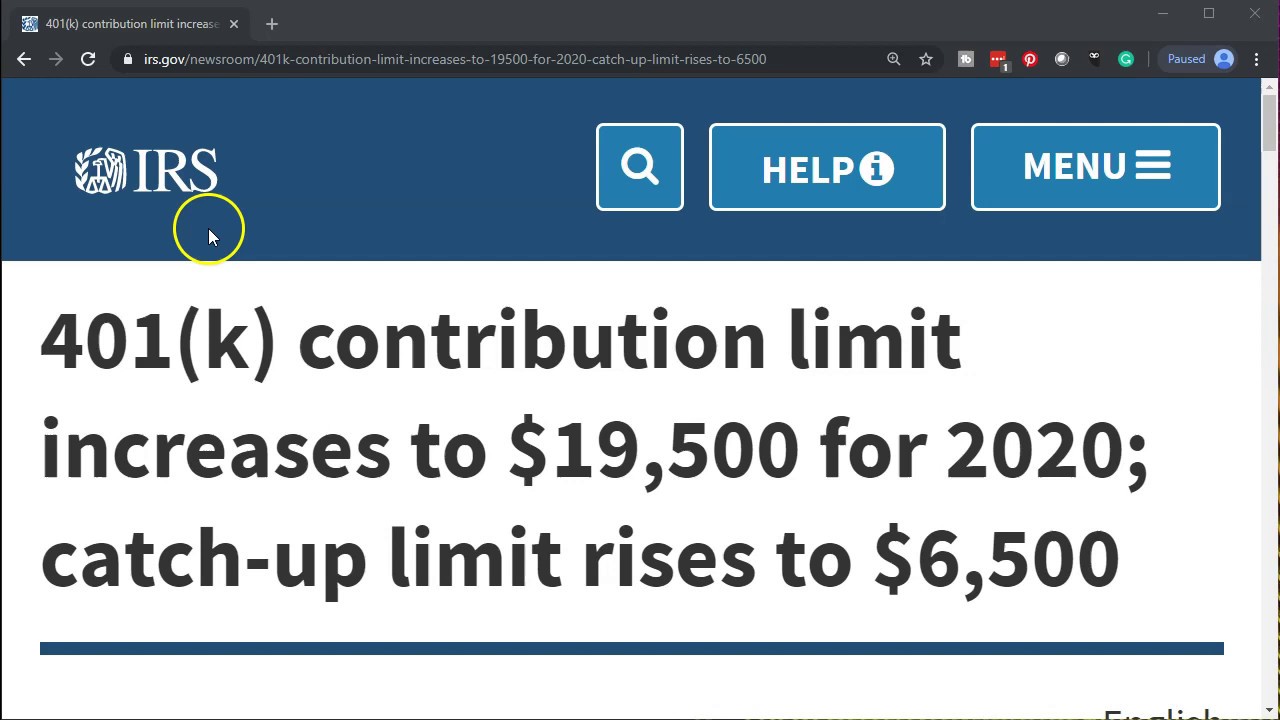

401k And Ira Max Contribution - For 2020 your individual 401 k contribution limit is 19500 or 26000 if youre age 50 or older. 401 k contribution limit increases to 19500 for 2020.

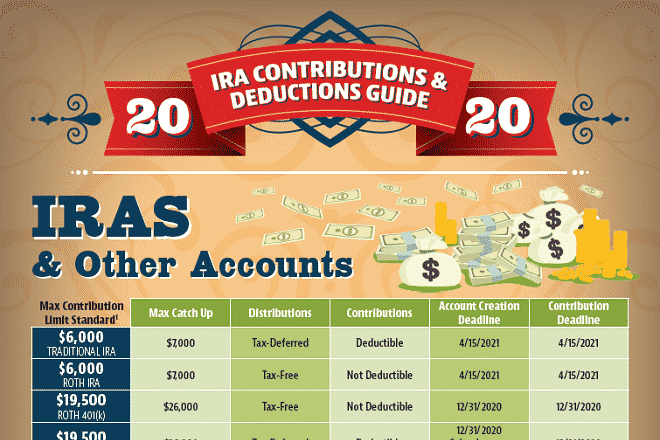

2020 2021 Ira Contribution Limits Catch Up Provisions Equity Trust Company

2020 2021 Ira Contribution Limits Catch Up Provisions Equity Trust Company

Under the new law the IRA catch-up contribution would be indexed to inflation beginning in 2022.

Max 401k and ira contribution 2020. This year you are allowed an annual contribution of up to 19500 in your 401k if you are under age 50. The 401 k catch-up contribution limit for workers 50 and older rises from 6000 to 6500 so in total those. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US. WASHINGTON The Internal Revenue Service today announced that employees in 401 k plans will be able to contribute up to 19500 next year. The maximum contribution to a 401k this year is 19500 up from 19000 in 2019.

Disbursement help free help. 6000 7000 if youre age 50 or older or. Anzeige Non Resident Alien from the US Retirement Withdrawal 401k US.

IR-2019-179 November 6 2019. 401 k Catch-Up Limits Would Rise Those 50. For 2021 2020 and 2019 the total contributions you make each year to all of your traditional IRAs and Roth IRAs cant be more than.

If less your taxable compensation for the year. 21 Zeilen Employers could contribute up to 57000 catch-up at 63500 in 2020. The IRS will let you put more money into your 401k account in 2020.

Phaseout for Traditional IRA Contribution Deduction. News 401k IRA pension contribution limits for 2020. Catch-up limit rises to 6500.

Max 401k Contribution And Roth Ira. 401 k contribution limits will increase from 19000 in 2019 to 19500 in 2020. IRS Heres your retirement plan cheat sheet for contribution limits to 401ks IRAs pensions and more.

AGI Limit for Full Traditional IRA Contribution Deduction. Max 401k Contribution And Roth Ira - For 2020 your individual 401 k contribution limit is 19500 or 26000 if youre age 50 or older. 401k And Ira Max Contribution.

Single or head of household. This is a 500 increase from 2019. IRA 401K withdrawal Non Resident Alien 401K IRA retirement reduce tax International Tax.

2020 401k Contribution Limits Unlike IRA contribution limits the amount you are able to save in your 401k has been increased by 500. Based on the above chart you can see how 401k savings can really start adding up over time. And remind them that they have until December 31 to maximize their 2020 contributions So what.

The no growth end assumes a consistent maximum contribution at the 2021 limit of 19500 after the first year contribution of 8000 with zero company match and zero growth. Disbursement help free help.

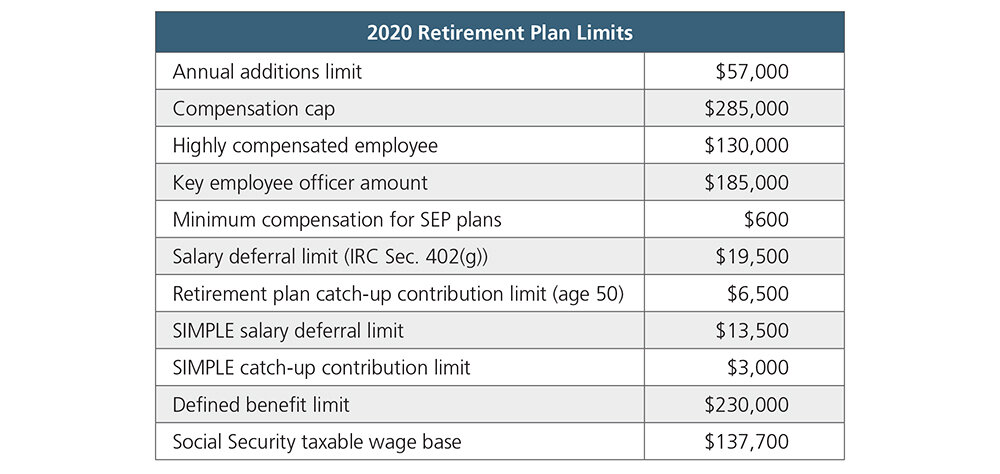

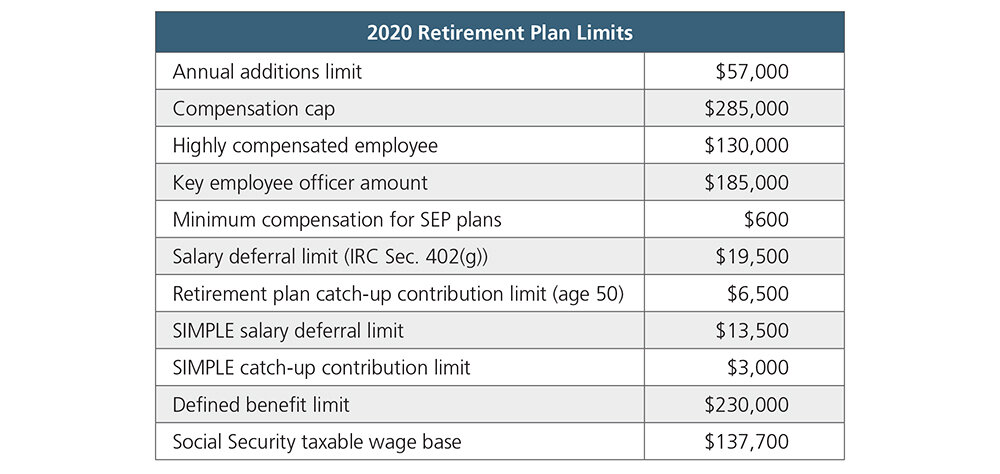

Maddox Thomson Associates 2020 Contribution Limits For Iras And Retirement Plans

Maddox Thomson Associates 2020 Contribution Limits For Iras And Retirement Plans

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

The Maximum 401 K Contribution Limit For 2020 Goes Up By 500

What S The Maximum 401k Contribution Limit In 2019 Mintlife Blog

What S The Maximum 401k Contribution Limit In 2019 Mintlife Blog

Retirement Contribution Limits For 2020 Retirement News

Retirement Contribution Limits For 2020 Retirement News

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Retirement Plan Contribution Limits Will Increase In 2020 Ward And Smith P A Jdsupra

Your 2020 Annual Contribution Limits Midatlantic Ira

Your 2020 Annual Contribution Limits Midatlantic Ira

Irs News 401 K Contribution Limit Increases To 19 500 For 2020 Catch Up Limit Rises To 6 500 Youtube

Irs News 401 K Contribution Limit Increases To 19 500 For 2020 Catch Up Limit Rises To 6 500 Youtube

2020 Irs Contribution Limits For Retirement Plans Fiduciary Financial Partners

2020 Irs Contribution Limits For Retirement Plans Fiduciary Financial Partners

2020 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

2020 Ira 401k And Roth Ira Contribution Limits Roth Ira Eligibility Ira Tax Deductions And More Begin To Invest

Why Is The Limit For Ira Contributions Lower Than 401 K Contributions Quora

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

401 K Contribution Limits 2020 What Employers Need To Know

401 K Contribution Limits 2020 What Employers Need To Know

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

2019 Ira Contribution Limits Unchanged For 2020 401k And Hsa Caps Rise Investor S Business Daily

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Many Ira And Retirement Plan Limits Will Increase For 2020 Ascensus

Comments

Post a Comment