What Is Medigap Plan F

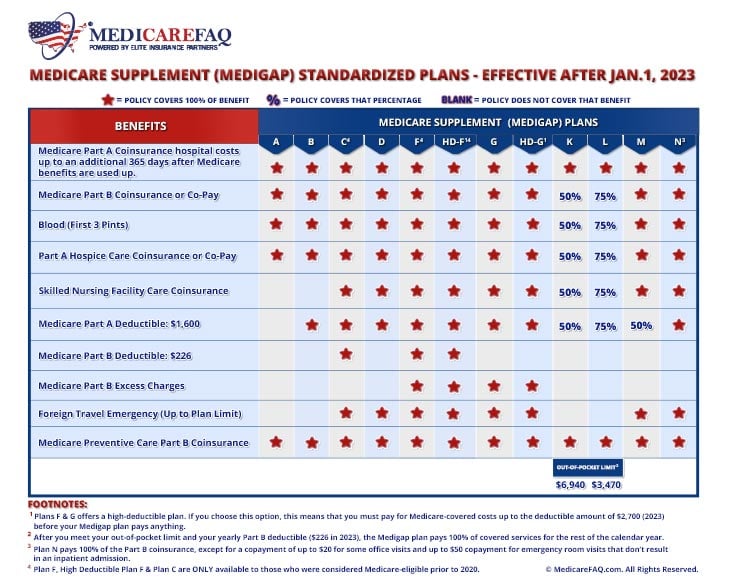

There is nothing unique about Plan F but it is notably the most comprehensive plan available. Plan F is one of 10 Medigap plans.

Important Information About Medigap Plan F The Med Sup Store

So this means if you have Plan F you pay your monthly plan premium for the supplement and then you pay no other costs for Medicare covered services.

What is medigap plan f. Whether you have a hospital stay or a diagnostic exam or a doctors visit you will simply present your Medicare card along with your Plan F supplement card. Medigap Plan F is one of multiple Medigap plans out. Medigap Plan F is one of the 10 standardized Medicare Supplement Insurance plan options sold in most states.

Medigap Plan F is the most comprehensive Medigap plan covering 100 of your cost-sharing. They can also cover certain care not provided by Original Medicare. It is designed to fill in all the gaps in original Medicare coverage Part A hospital and Part B doctoroutpatient.

The plan pays the first dollar of the first medical bill and the beneficiary never writes a check when using. With this option you. These plans are also known as Medigap plans because they help bridge some of the gaps that Medicare doesnt cover like coinsurance copayments or deductibles.

Medigap Plan F aka Medicare Supplement Plan F covers the most amount of services out of all the supplemental plans. A Medicare Supplement plan is insurance you can purchase to supplement your Original Medicare coverage. 12 Zeilen Plans F and G also offer a high-deductible plan in some states.

This post has been updated for 2021. That means you could see a doctor with little to no money out of your own pocket. Like many other Medigap policies Plan F also covers Part B copayments and the deductible.

Medigap Plan F is currently the most common and comprehensive Medigap plan. Plan C is the other. Medicare Supplement Plan F has also been the 1 seller with Baby Boomers for many years.

Medicare supplement insurance Medigap is a type of Medicare insurance policy that can help pay for some costs that original Medicare parts A and B doesnt cover. From January 2020 new enrollees in Medicare cannot get Medigap Plan F. As stated in the name it supplements your Original Medicare by covering some out-of-pocket expenses you may incur.

If a person already has Plan F they can keep it. Medigap plans can step in to supplement many of these costs. It can help pay for expenses that arent covered under original Medicare.

Plan F basic benefits like other Medigap plans are standardized in most states. There are insurance companies out there that may also provide a high-deductible alternative to Plan F. Medicare Supplement Insurance Plan F.

This means that regardless of where you live or which insurance company you purchase from youll get the exact same basic benefits for a Plan F sold anywhere in your state note that there is also a high-deductible version of Plan F discussed below. Medigap Plan D and G on the other hand will be the guaranteed issue plan for those who were Medicare eligible after Jan 1st 2020. Medigap Plan F is the most comprehensive Medicare Supplement plan.

Plan F gives you first-dollar coverage for all Medicare-approved services. In fact 55 of Medigap beneficiaries in 2017 were enrolled in Plan F. If you are currently 70 year old but enrolling in Part B for the first time you can purchase plan F without medical underwriting since you were eligible for Medicare prior to Jan 1st 2020.

Plan F has been called the Cadillac of Medigap plans providing first-dollar coverage. Plan F covers the most standardized Medigap benefits and is the most popular Medigap plan. You will be good to go.

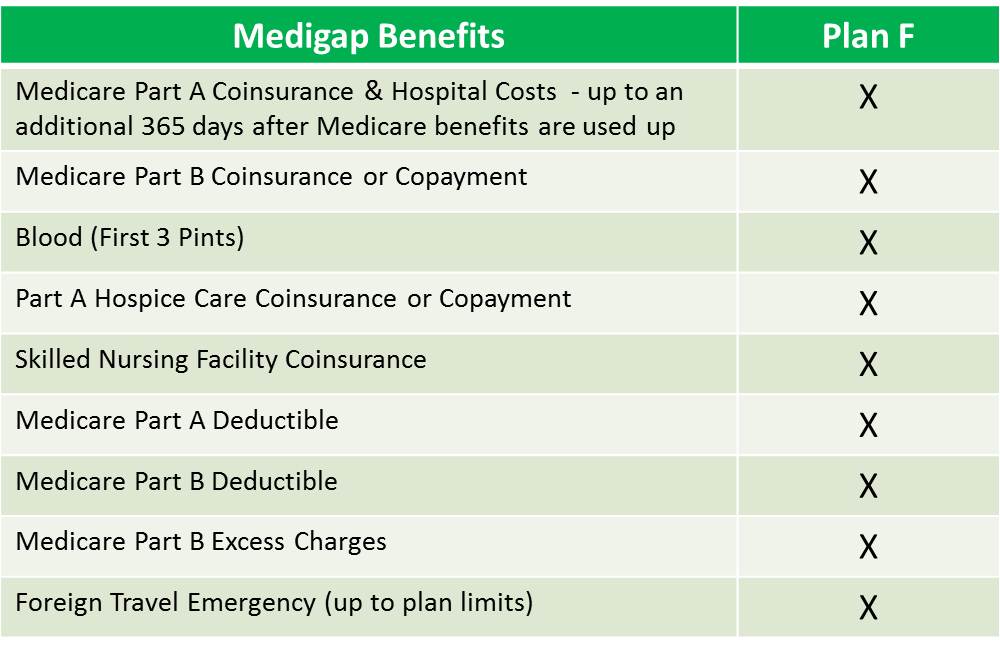

Plan F covers the following. Plan F is simply one of the Medigap policies that is available and is currently the most popular plan. However Medigap plans do not offer Part D prescription drug coverage nor do they cover things like dental vision or hearing aid services.

Plan F is a plan thats included in Medicare supplement insurance Medigap. Also referred to as Medicare Supplement Plan F it covers both Medicare deductibles and all copays and coinsurance leaving you with nothing out-of-pocket. Medicare Supplement Plan F or 2020 Medigap Plan F has been a favorite among many because it has the most robust benefits.

Plan F is for beneficiaries looking for full coverage for all out-of-pocket costs including. Getting Medigap Plan F. Plan F is one Medigap option.

Plan F is one of two Medicare Supplement plans that covers Part B excess charges what some doctors charge above what Medicare pays for a service.

Medigap Plan F The Most Common And Comprehensive Plan

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medigap Plan F Medicare Supplement Plan F 65medicare Org

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Medicare Plan F Vs Plan G A Medicare Supplement Quick Guide Health Plans In Oregon

Plan F Vs Plan N Which Medigap Plan Is Right For You Infographics By Graphs Net

Plan F Vs Plan N Which Medigap Plan Is Right For You Infographics By Graphs Net

Medicare Supplement Plan Comparison Medicare Nationwide

Medicare Supplement Plan Comparison Medicare Nationwide

Medigap Plan F Medicare Supplement Plan F

Mutual Of Omaha Medicare Supplement Mutual Of Omaha Medicare

Mutual Of Omaha Medicare Supplement Mutual Of Omaha Medicare

Compare Medigap Plans Comparison Chart For 2021 Medicarefaq

Compare Medigap Plans Comparison Chart For 2021 Medicarefaq

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Supplement High Deductible Plan F Florida Senior Healthcare Direct

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Supplement Plan F Quote Senior Healthcare Direct

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Medicare Plan F Why Boomers Prefer Plan F Medicare Part F Covers

Comments

Post a Comment