Can You Have A 401k And An Ira

You can roll over from a traditional 401k into a traditional IRA tax-free. Yes you can contribute to both a 401 k and an IRA at the same time.

Can You Contribute To A 401k And An Ira In The Same Year Money Girl

Can You Contribute To A 401k And An Ira In The Same Year Money Girl

The simple answer is yes you can.

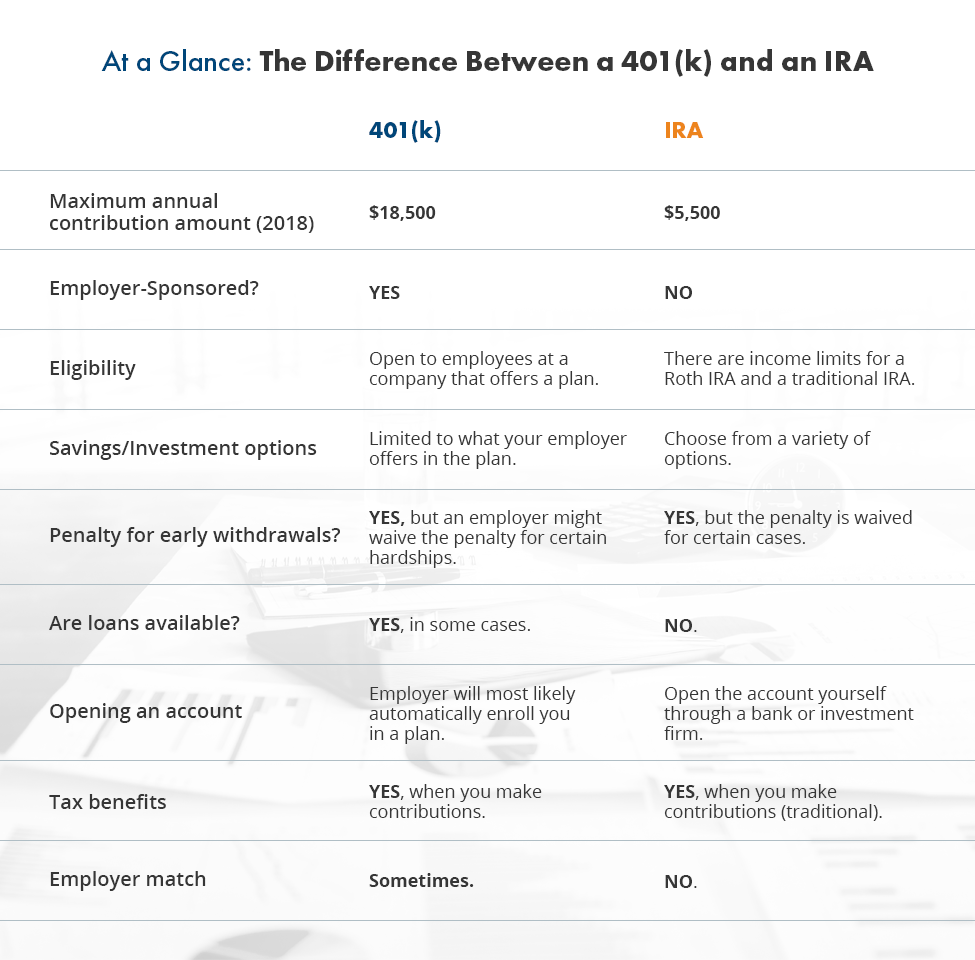

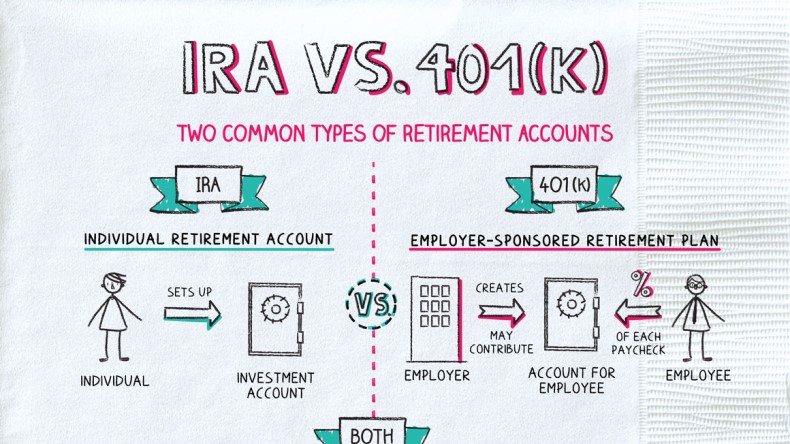

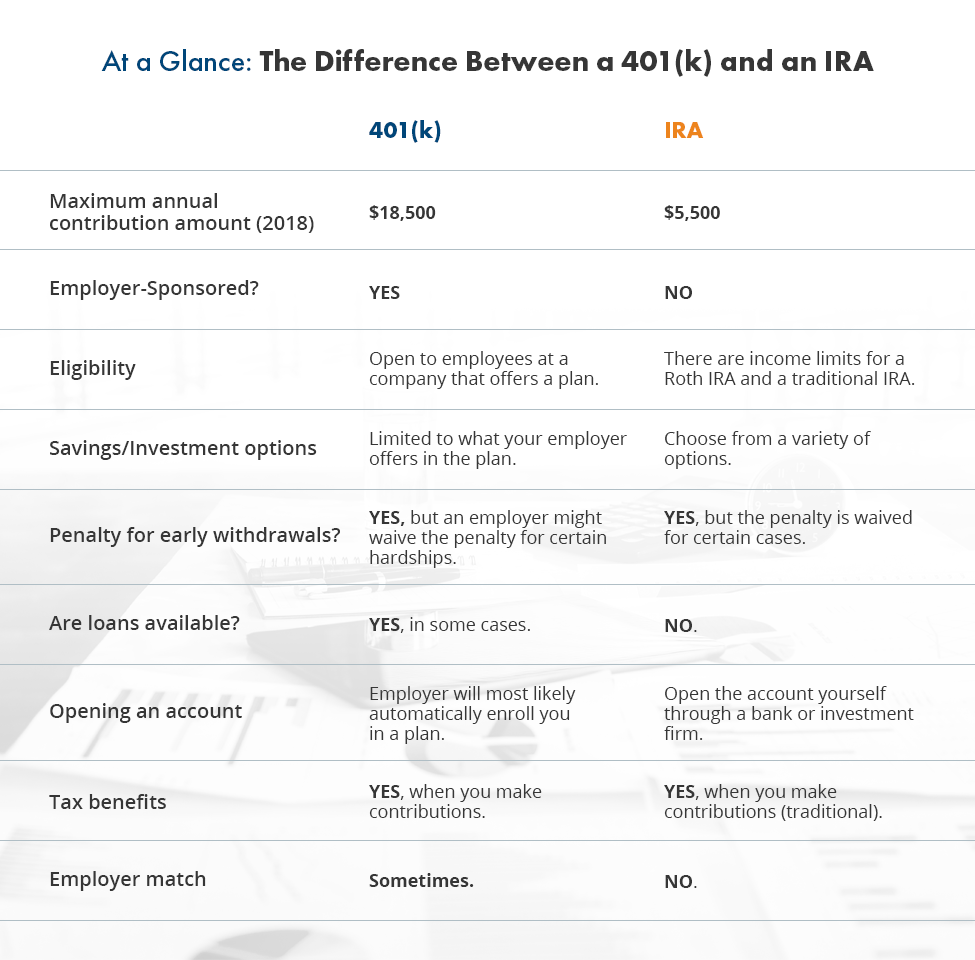

Can you have a 401k and an ira. And in some cases based on the fees in your 401k an IRA might actually be a better place to invest your money. While a 401 k and an IRA will both help you save for your retirement there are a few important differences. A 401 k is established by an employer.

Yes No In most states a Medicaid applicants pension 401K IRA or other retirement account will either be considered as an asset or as income. But if you want to diversify your assets across stocks ETFs bonds options and more a brokerage is the way to go. IRA Deduction if You ARE Covered by a Retirement Plan at Work - 2020.

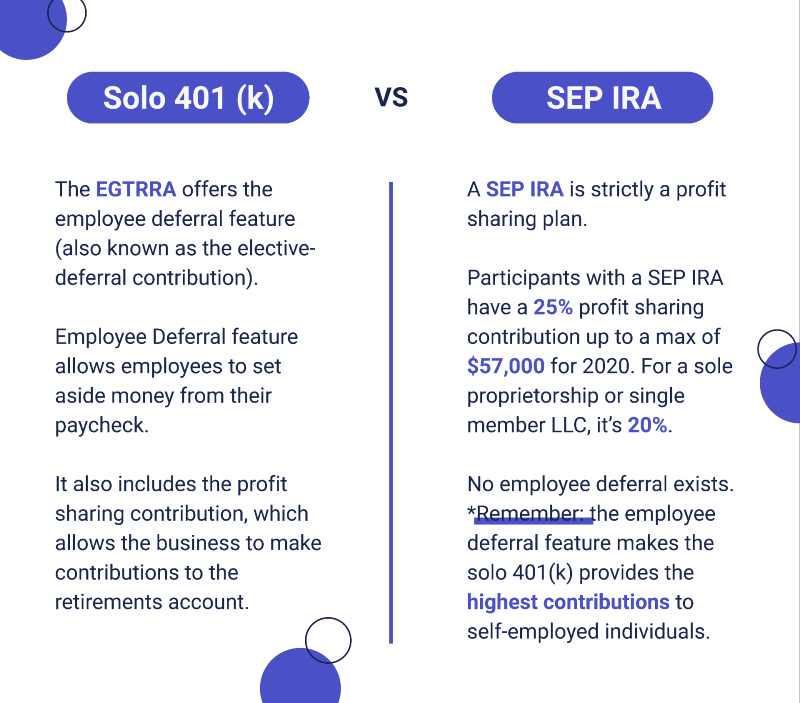

If your employer offers a 401 k match contribute enough to get all of that free money. 401ks often have minimal choices with target-date funds being some of the most common. But fortunately for your retirement nest egg you can contribute to both types of retirement accounts.

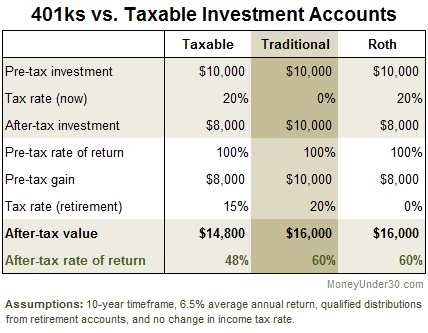

2 days agoIf you have a 401k at work and your salary surpasses 76000 or 125000 for couples if both spouses have a 401k you may not be able to deduct your contributions to a traditional IRA. Yes you can contribute to both a 401 k and a Roth IRA but there are certain limitations youll have to consider. However your ability to take a tax deduction for your IRA may be limited depending on factors like your income and whether your spouse is covered by an employer-sponsored retirement.

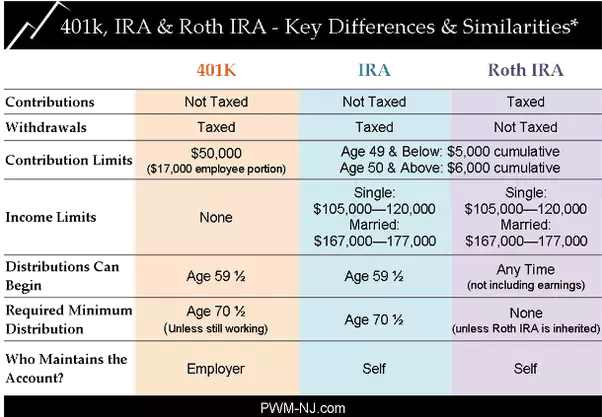

This article will go over how to determine your eligibility for a Roth IRA. Those age 50 can contribute an additional 6500 for a total of 26000. Limits on 401k and IRA Contributions.

If you have a traditional 401k plan that means you didnt pay taxes on the money when you contributed it to your account. If youre under 50 you can contribute 19500 to a 401 k for 2021. Whether or not you choose to open an IRA if your employer offers a Roth 401 k you might also consider adding this to your retirement savings strategy.

Same goes for a Roth 401k-to-Roth IRA rollover. Actually it is quite common to have both types of accounts. In fact you can contribute up to the annual limit to each account thereby maximizing your retirement savings.

If it is an asset it will count against Medicaids asset limit for eligibility. Yes you can contribute to a traditional andor Roth IRA even if you participate in an employer-sponsored retirement plan including a SEP or SIMPLE IRA plan. The spousal IRA however is.

Can You Have a 401k and an IRA at the Same Time. It is a question that comes up frequently when it comes to retirement planning. You can have a 401k plan and an individual retirement account IRA at the same time.

However there are some caveats when it comes to deducting your IRA contributions if you participate in both types of plans. The quick answer is yes you can have both a 401 k and an individual retirement account IRA at the same time. If you want to move that money into a Roth IRA youll have to pay taxes on it.

Generally you cant contribute to an individual retirement account IRA unless you earn an income in a given year. Yes you can invest in both an IRA and a 401k or a Roth 401k and a Roth IRA at the same time or any combination of those accounts. There are no income limits to participate in a Roth 401 k and you can have both types of 401 k at the same time.

Can I contribute to a 401k and an IRA. On top of that those under 50 can contribute an additional 6000 to an IRA. Heres a good way to approach deciding between a 401 k and an IRA assuming you cant max out both.

IRA Deduction if You Are NOT Covered by a Retirement Plan at Work - 2020 deduction is limited only if your spouse IS covered by a retirement plan See Publication 590-A Contributions to Individual Retirement Arrangements IRAs for additional information including how to. See the discussion of IRA Contribution Limits. One major reason that rolling over your 401k can be helpful is that IRA providers boast better investment selections.

You Can Contribute To Both A 401k And An Ira Every Year

401 K Or Ira How To Choose Where To Put Your Money Ellevest

401 K Or Ira How To Choose Where To Put Your Money Ellevest

401 K Vs Ira How To Decide Human Interest

Can I Contribute To A 401k And An Ira Personal Capital

Can I Contribute To A 401k And An Ira Personal Capital

Why Choose A Solo 401k Vs Sep Ira Plan Ira Financial Group

Why Choose A Solo 401k Vs Sep Ira Plan Ira Financial Group

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

What S The Difference Between A 401k And Ira And Which Should You Invest In Money Under 30

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is 401k Ira Vs 401k Retirement Answers From Napkin Finance

What Is The Difference Between A 401k And Ira Quora

What Is The Difference Between A 401k And Ira Quora

401 K Vs Ira Which Is The Better Choice For You Mid Penn Bank

401 K Vs Ira Which Is The Better Choice For You Mid Penn Bank

/saving-in-both-a-401-k-and-a-roth-ira-7ac553decd2e4812b68d8c7c64c5434b.png) Saving In Both A 401 K And A Roth Ira Can Be A Good Idea

Saving In Both A 401 K And A Roth Ira Can Be A Good Idea

Roth Ira Or Traditional Ira Or 401 K Fidelity

Roth Ira Or Traditional Ira Or 401 K Fidelity

Comments

Post a Comment