What Is The Interest Rate On A Construction Loan

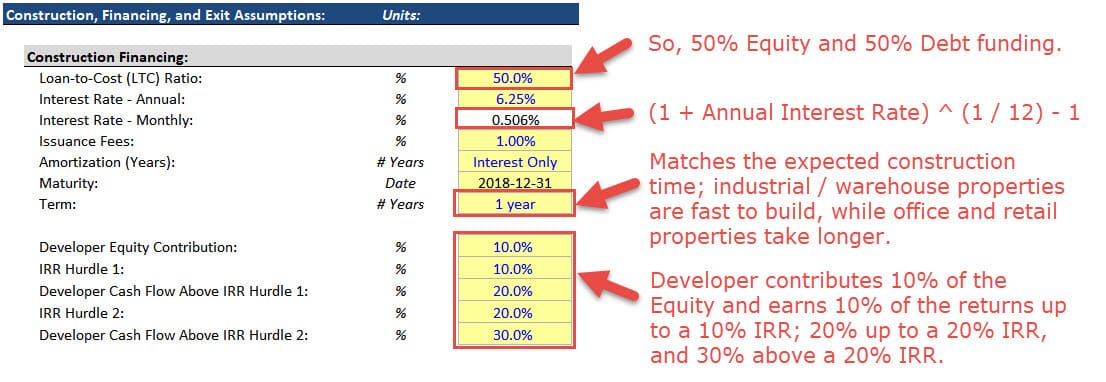

Loan Interest Rate. Again per the scenario the interest rate is fixed at 400 for the construction term and it is a direct input into the calculator.

Construction Loan 1 99 Interest Rate For 12 Months Home Federal Savings Bank Owatonna Owatonna Mn

Construction Loan 1 99 Interest Rate For 12 Months Home Federal Savings Bank Owatonna Owatonna Mn

Whats more interest rates for construction loans typically are variable meaning they adjust over the course of the loan based on an index like the prime rate.

What is the interest rate on a construction loan. About Commercial Construction Loan Rates. It is therefore difficultif not impossible to accurately estimate what the payments will actually be as the loan amount is subject to. And since banks are NOT in the business of building homes they will mitigate this risk charging higher interest rates on construction loans.

The Encyclopedia of Commercial Real Estate Advice a WILEY book OUT NOW. Construction loans typically have variable interest rates that correspond to a certain percentage over the prime rate or the rate that banks give their best. Youll make interest-only payments on the funds drawn on your loan during construction.

By Terry Painter Mortgage Banker. During the construction period you will be billed monthly for interest due based on the outstanding balance of your construction loan during the month. It also provides the option for a 14-day fast-track closing for a fee of 1250.

If you have owned your lot for 12 months or longer at the time of your loan application your maximum loan amount is based on the full value of the property rather than the original sales price. Interest on a construction loan is a very simple formula that anyone can calculate. Its ideal for time-strapped customers as loan approvals generally occur within 21 days.

Your APR will vary based on your final loan amount and finance charges. So if the prime rate is 2 percent you would be charged a total of 4 percent. For a single-close construction loan plan on paying 15 to 3 higher.

Starts at 0 for VA loan and 35 for FHA loan but the average is 11 for a construction loan as of February 2021 Rates vary depending on. The greatest risk to the bank closing a construction loan is having either the builder or buyer default during construction and the higher rates allow them to spread that risk. D uring construction a construction loans payments are based on the loan amount actually drawn unless if the loan is a hard money loan in which case the entire amount is deposited into an escrow account and interest is charged on the entire loan amount.

Loan interest rates for these government programs are very close to each other typically within one percentage point. If your current interest rate is 775 you simply take the balance that has been drawn or borrowed. If the prime rate is increased to 25 percent then the rate charged on your loan would be increased to 45 percent for the remaining term of the loan or until the prime rate is changed again.

The funds from these construction loans are disbursed based upon the percentage of the project completed and the borrower is only responsible for interest payments on. Member of the Forbes Real Estate Council Author. The interest rates annual percentage rates APRs and discount points shown are subject to change without notice.

Per the scenario the construction term is 6 months. In some instances a hard money loan average interest rate can be as high as 10 20 if you have an LTV ratio of 50-55 with a typical minimum loan of 150000 with a two-year repayment timeframe The LTV rate interest rates and other figures listed above are projected but not guaranteed. The construction loan interest rates you get will depend on the particular type of construction you pursue.

Construction interest rates are generally set at prime rate plus 2 percent. For instance your interest rates will generally be lower when constructing an office building than a. They have higher interest rates.

Commercial Construction Loan Rates vary from around 400 to 1200 based on the lenders cost of funds. The payments made during the build are interest-only and then you settle your balance as you roll the principal into your 30-year fixed-rate mortgage. Normandy typically charges an interest rate of up to 1095 APR and requires a minimum deposit of 25 for construction loans.

Construction loans can allow a borrower to build the home of their dreams butdue to the risks involvedthey have higher interest rates and larger down payments than. The interest rate is variable during the build period and becomes fixed for the mortgage part of it.

Interest Rate On A Construction Loan Rating Walls

Interest Rate On A Construction Loan Rating Walls

How To Calculate An Interest Reserve For A Construction Loan

How To Calculate An Interest Reserve For A Construction Loan

Interest Rate On A Construction Loan Rating Walls

Interest Rate On A Construction Loan Rating Walls

Commercial Construction Loans How To Get Construction Lending The Jerusalem Post

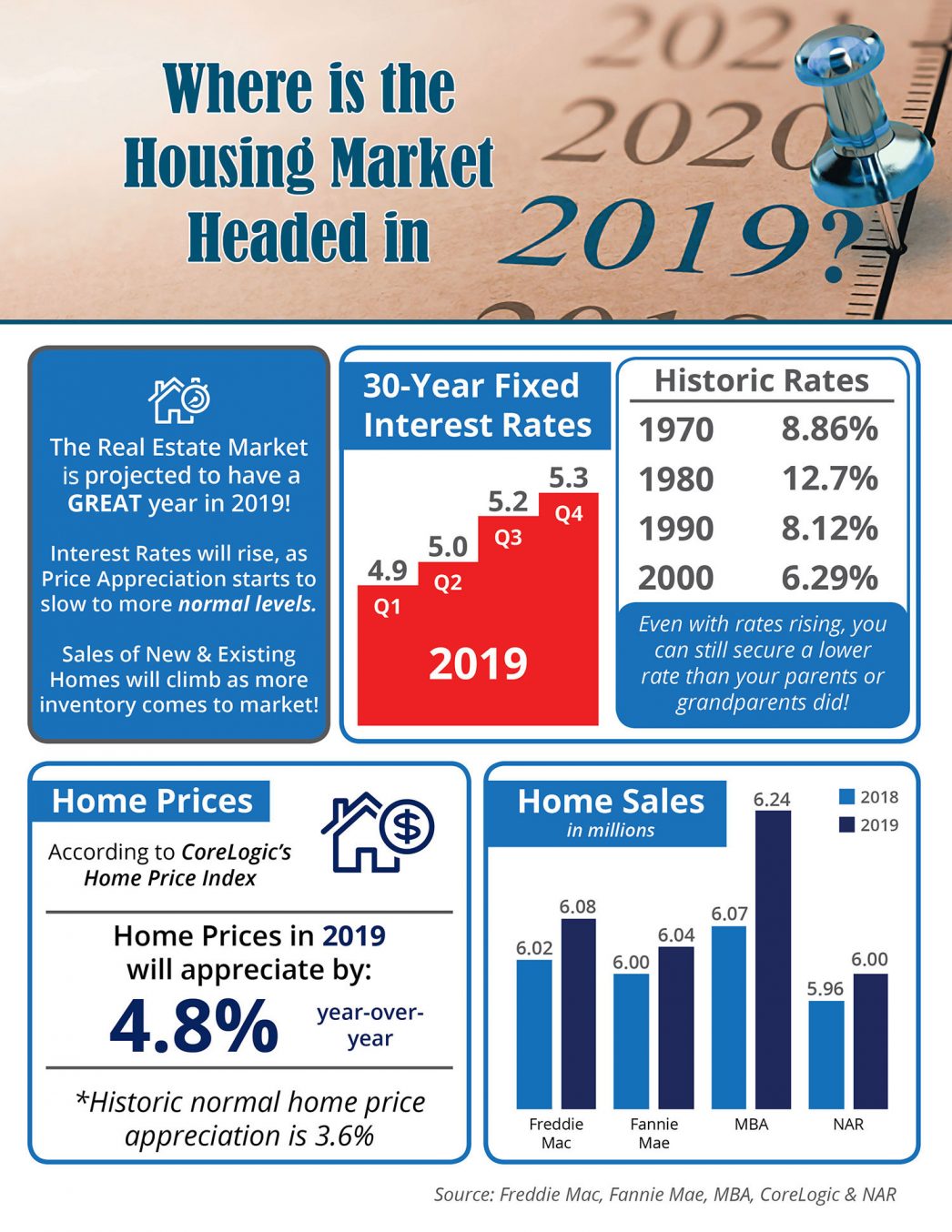

Physician Construction Loan In Florida Where Is The Housing Market Headed In 2019 Physician And Doctor Loans Physician Loans Usa

Physician Construction Loan In Florida Where Is The Housing Market Headed In 2019 Physician And Doctor Loans Physician Loans Usa

Interest Rates On Construction Loans Showed Rising Trend In 2018 Eye On Housing

Interest Rates On Construction Loans Showed Rising Trend In 2018 Eye On Housing

Interest Rate On A Construction Loan Rating Walls

Interest Rate On A Construction Loan Rating Walls

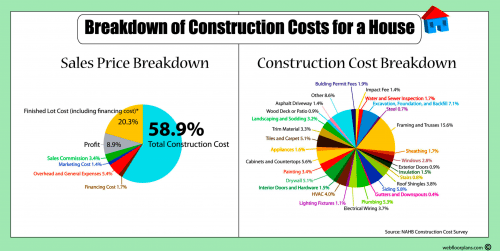

Complete Guide To Building A House Financial Steps

Complete Guide To Building A House Financial Steps

How Home Construction Loans Work Lendingtree

How Home Construction Loans Work Lendingtree

How To Calculate An Interest Reserve For A Construction Loan

How To Calculate An Interest Reserve For A Construction Loan

Everything You Need To Know About Construction Loans

Everything You Need To Know About Construction Loans

/basics-of-construction-loans-315595_final-c0f70269da9347709bd6327c9e242f60.png) Construction Loans Funds To Build And Buy Land

Construction Loans Funds To Build And Buy Land

Rates On Construction Loans Continue To Drift Downward Eye On Housing

Rates On Construction Loans Continue To Drift Downward Eye On Housing

Interest Rate On A Construction Loan Rating Walls

Interest Rate On A Construction Loan Rating Walls

Comments

Post a Comment