California Capital Gains Tax Rate 2020

2020 California State Salary Examples. Figure how much of any gain is taxable.

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

If you do not qualify for the exclusion or choose not to take the exclusion you may owe tax on the gain.

California capital gains tax rate 2020. Additional State Income Tax Information for California. People earning more than 1m in high-tax states could see higher rates in New York combined state and federal capital gains rates would top 52 per cent or more than 56 per cent in California. The tax rate on long-term capital gains.

Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040. Your gain is usually the difference between what you paid for your home and the sale amount. 52 rows The Capital Gains Tax Calculator is designed to provide you an estimate on the cap gains.

When you take into consideration that the IRS can also levy a maximum of 37 percen t in federal taxes on your capital gains it becomes crystal clear how and why capital gains in California are among the highest taxed in the world. 51 rows California has the highest capital gains tax rate of 1330. This is the highest marginal capital gains tax rate in the United States.

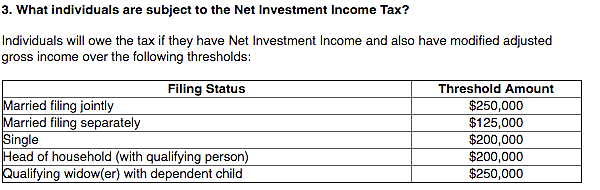

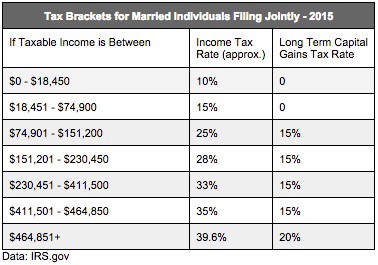

And hes likely looking to raise it only on Americans who make more than 1 million in a year. The federal capital gains tax rate is 0 to 15 for most taxpayers with higher earners paying as much as 20. Additional State Capital Gains Tax Information for California The Combined Rate accounts for Federal State and Local tax rate on capital gains income the 38 percent Surtax on capital gains and the marginal effect of Pease Limitations which results in a tax rate increase of 118 percent.

In 2020 the capital gains tax rates are either 0 15 or 20 for most assets held for more than a year. It also includes an additional 38 tax on high-income investments that have been in place since 2013 to support Affordable Care Act payments. Throw in state taxes in a place such as California and the rate.

2020 California State Sales Tax Rates The list below details the localities in California with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator. To report your capital gains and losses use US. The 0 bracket for long-term capital gains is close to the current 10 and 12 tax brackets for ordinary income while the 15 rate for gains corresponds.

This means your capital gains taxes will run between 1 up to 133 depending on your overall income and corresponding California tax bracket. How much these gains are taxed depends a lot on how long you held the asset before selling. What is Biden trying to change.

If you have a difference in the treatment of federal and state capital gains file California Capital. Simply put California taxes all capital gains as regular income. For them he wants the rate to rise to 396 from 20.

California does not have a lower rate for capital gains. In total the marginal capital gains tax rate for California taxpayers is 33. This means your capital gains taxes will run between 1 up to 133 depending on your overall income and corresponding California tax bracket.

Including Californias 133 capital gains tax rate and New Yorks 1185 hit plus a 388 tax bite in New York City and the new rate would climb close to 60 in those states. Determine if you have a gain or loss on the sale of your home. Determining Your 2020 California Income Tax.

It does not recognize the distinction between short-term and long-term capital gains. With an increased ordinary tax rate of 396 plus the 38 Obamacare tax the capital gains tax rate would be 434. Use Selling Your Home IRS Publication 523 to.

All capital gains are taxed as ordinary income. 2020 California State Salary Comparison Calculator. The Biden plan would push the top rate paid on both types of income to 396 percent taking a page out of Californias playbook the state levies a 133 percent tax rate on both capital gains.

This includes a 20 tax on investments held for more than a year known as the long-term capital gains tax. This is maximum total of 133 percent in California state tax on your capital gains. Tax rate on long-term capital gains.

How to report Federal return. This includes the state income tax and the federal capital gains tax. California has notoriously high.

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Tax Implications Of Selling Commercial Real Estate 2021 Guide Property Cashin

Short Term And Long Term Capital Gains Tax Rates By Income

Short Term And Long Term Capital Gains Tax Rates By Income

2021 Capital Gains Tax Calculator See What You Ll Owe Smartasset

2021 Capital Gains Tax Calculator See What You Ll Owe Smartasset

California Taxes A Guide To The California State Tax Rates

California Taxes A Guide To The California State Tax Rates

12 Ways To Beat Capital Gains Tax In The Age Of Trump

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How Are Capital Gains Taxed Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

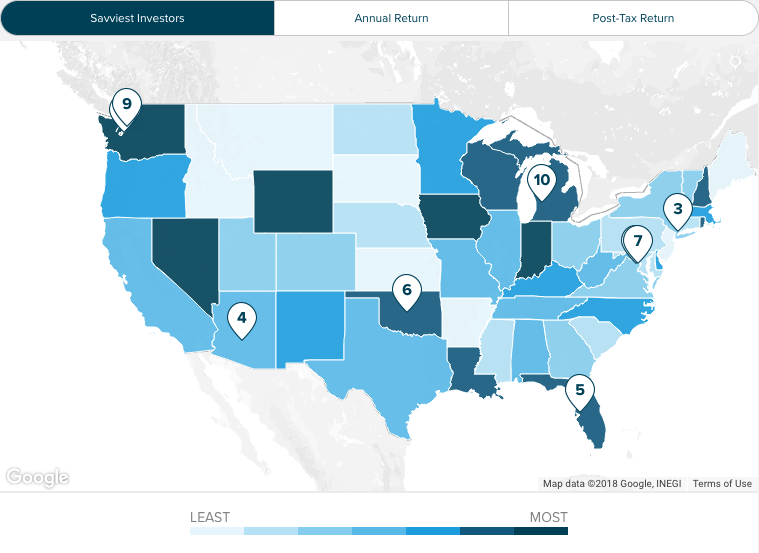

State Capital Gains Taxes Where Should You Sell Biglaw Investor

State Capital Gains Taxes Where Should You Sell Biglaw Investor

State Capital Gains Taxes Where Should You Sell Biglaw Investor

State Capital Gains Taxes Where Should You Sell Biglaw Investor

How Are Capital Gains Taxed Tax Policy Center

How Are Capital Gains Taxed Tax Policy Center

2.png) How High Are Capital Gains Tax Rates In Your State Tax Foundation

How High Are Capital Gains Tax Rates In Your State Tax Foundation

عدواني الحالة مطار Short Capital Gain Tax Psidiagnosticins Com

عدواني الحالة مطار Short Capital Gain Tax Psidiagnosticins Com

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

Comments

Post a Comment