Pmi Down Payment

In general PMI costs range from 030 to 115 of your loan balance annually. To sum up when it comes to PMI if you have less than 20 of the sales price or value of a home to use as a down payment you have two basic options.

Understanding Pmi Private Mortgage Insurance We Sell Oklahoma

Understanding Pmi Private Mortgage Insurance We Sell Oklahoma

So PMI is a reasonable concept overall but its still a huge ripoff.

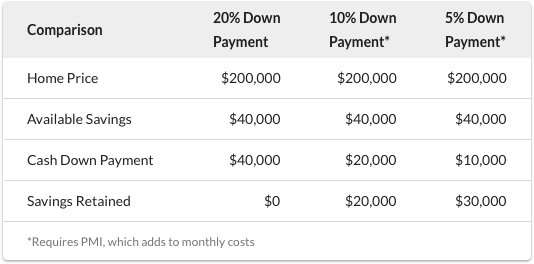

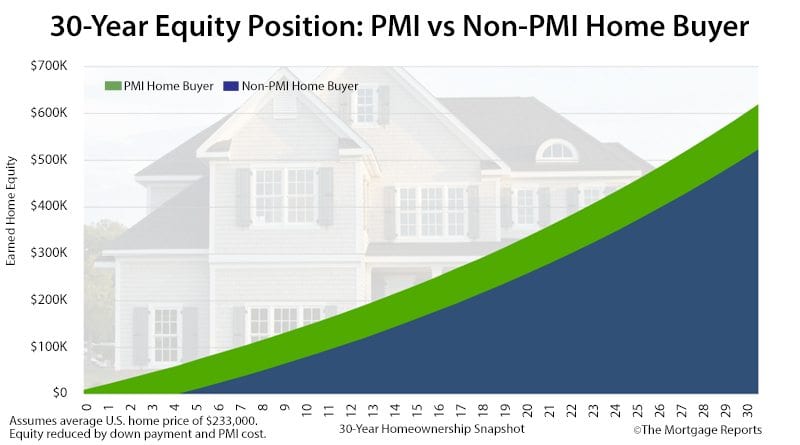

Pmi down payment. The buyer has some saving to do. Use a stand-alone first mortgage and pay PMI. Generally if you need financing to buy a home and make a down payment of.

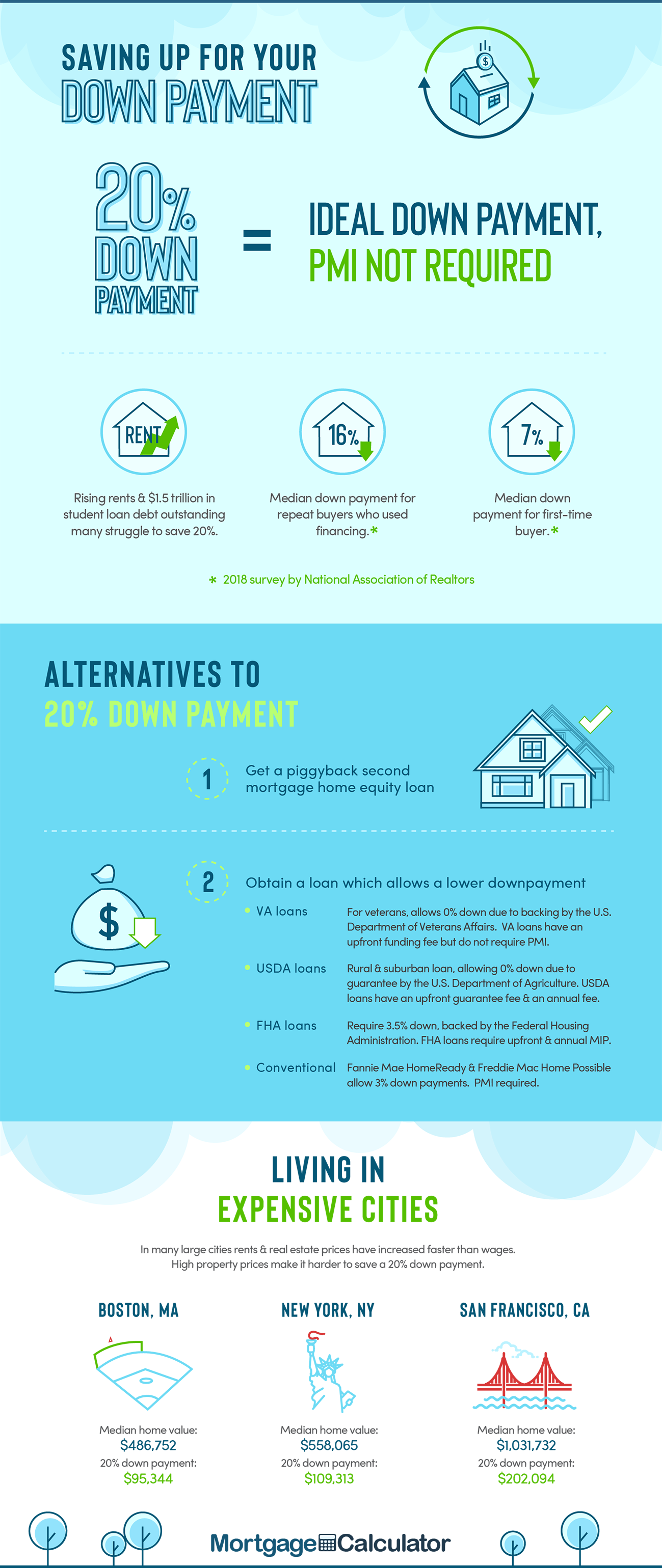

Heres some run of the mill numbers to get us started. In order to calculate what kind of return paying extra on a mortgage with PMI gets its easiest to talk about if we have some numbers to work with. 15 more than the buyer who chose PMI.

Lenders charge PMI to cover some of their risk if you do not put the 20 percent down to create equity. After the price appreciation since 2012 millions of homeowners have more than 20 equity in their home and could have their PMI removed or refinance into a new loan without PMI. The average annual cost of PMI typically ranges from 058 to 186 of the original loan amount according to Genworth Mortgage Insurance Ginnie.

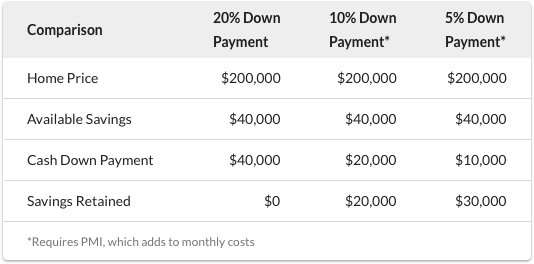

Down payment assistance programs can also be a helpful way for buyers to stay competitiveparticularly in todays fast-moving low-inventory market. If the down payment is lower than 20 borrowers will be asked to purchase Private Mortgage Insurance PMI to protect the mortgage lenders. Most lenders offer conventional loans with PMI for down payments ranging from 5 percent to 15 percent.

PMI is is a form of insurance that mortgage lenders use to reduce the risk of loss on low down payment mortgages. Lenders typically require it on mortgages for more than 80 of a. So if you have only 10 to put down.

Private mortgage insurance PMI is an insurance policy that protects lenders from the risk of default and foreclosure. He or she budgets and plans to. The insurance does not cover the entire loan amount only a small percentage.

The smaller your down payment for example the higher you should expect your PMI costs to run. The PMI is normally paid as a monthly fee added to the mortgage until the balance of the loan falls below 80 or 78 of the home purchase price. Since PMI is a cost that does not lower your interest rate or principal its almost always better to save up that hefty down payment.

For a loan with a down payment of less than 20 you will have as part of your monthly mortgage payment an additional payment for PMI. Most lenders require you to put at least 20 percent down or pay private mortgage insurance PMI. The PMI calculator starts by asking for the price of the home you want to buy and your anticipated down payment amount to calculate a down payment percentage.

PMI ranges from 5 percent to 1 percent of the amount you borrowed paid out in equal monthly payments every year. On the bright side. Typically conventional loans require PMI when you put down less than 20 percent.

Instead he or she opts for a 20 down payment. Thus a loan amount of 200000 could have a 2000 per year PMI premium which is about 167 per month added to your mortgage payment until the lender agrees to cancel the premiums. If you cant pay for a standard 20 down payment your bank will make you pay for PMI to insure their loan against default.

If buyers have a down payment programespecially one that includes closing cost helpand dont need the seller to help with closing costs they can make more attractive offers than competing buyers explains Moss. Initial Mortgage Loan Amount. Saving the Down Payment.

The most common way to pay for PMI is a monthly premium added to your monthly mortgage payment.

How To Lower The Down Payment On A New Home Leverage Pmi

How To Lower The Down Payment On A New Home Leverage Pmi

Home Loan Downpayment Calculator

Home Loan Downpayment Calculator

5 Types Of Private Mortgage Insurance Pmi

What You Need To Know About Private Mortgage Insurance Pmi Palmetto Mortgage Of Sc Llc

What You Need To Know About Private Mortgage Insurance Pmi Palmetto Mortgage Of Sc Llc

The Roi Of Eliminating Pmi With Principal Prepayments

The Roi Of Eliminating Pmi With Principal Prepayments

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance3-371bab72617d42d28def5f93c622d6e5.png) How To Outsmart Private Mortgage Insurance

How To Outsmart Private Mortgage Insurance

Should I Wait To Put Down A Bigger Down Payment Island Land Company Inc

What Is Pmi Understanding Private Mortgage Insurance

What Is Pmi Understanding Private Mortgage Insurance

/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png) Private Mortgage Insurance Pmi What Is It

Private Mortgage Insurance Pmi What Is It

Mortgage Insurance Cost Versus Benefits Should You Pay For Pmi Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Mortgage Insurance Cost Versus Benefits Should You Pay For Pmi Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Is A Conventional Loan 2021 Rates And Requirements

What Is A Conventional Loan 2021 Rates And Requirements

What Is Pmi Understanding Private Mortgage Insurance

What Is Pmi Understanding Private Mortgage Insurance

:max_bytes(150000):strip_icc()/HowtoOutsmartPrivateMortgageInsurance1-f53f53e537a14a069144d763f621795b.png) How To Outsmart Private Mortgage Insurance

How To Outsmart Private Mortgage Insurance

How Pmi Works Private Mortgage Insurance Explained Mint

How Pmi Works Private Mortgage Insurance Explained Mint

Comments

Post a Comment