How Property Taxes Work

If you buy a residential rental property you can divide the cost of acquiring the property minus the value of the land by 275 to determine your annual depreciation deduction. Different property types have various types of tax assessed on the land and its structures.

How Do State And Local Property Taxes Work Tax Policy Center

How Do State And Local Property Taxes Work Tax Policy Center

It may tax a percentage of your homes assessed value and multiply that number by the tax rate.

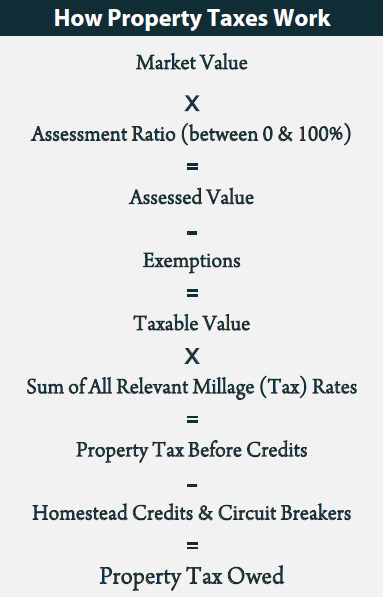

How property taxes work. A short video explaining your property taxes and the role of the Assessors Office. A property tax assessment is the market value of a property. Applying property tax rates.

This means that if the amount of taxes youve paid out over the course of the year exceeds those amounts youre not able to claim the full amount of your property taxes. There are three ways to value property. Property taxes are fees paid by real estate owners to a county or other local authority based on the assessed value of your property.

Doe ruling turned the property tax system on its head pushing property taxes sky high and on a track to get higher. The Tax Cuts and Jobs Act capped the deduction for state and local taxes including property taxes at 10000 5000 if youre married and filing separately. So your SEV is determined by the city assessor based on this years sold homes and what they know about your house When you buy a home the taxes in the first year are based on the SEV Your home will reset to the SEV times the millage rate After that your homes taxes will be the second figure you will see on your statement The second year you own your home your taxes will be the.

If you have an existing mortgage your assessed property taxes are split into monthly increments and added to your mortgage payment. Itemized Property Tax Deduction. Not so with public school funding.

Because school districts receive substantial intergovernmental transfers own. Property tax rates are normally expressed in mills. How property taxes work Determining the value of your home.

A tax assessor -- an elected or appointed official -- assesses the value of every taxable property in that assessment area. Once your property tax assessment is complete the city plugs it into its property tax formula. The lien generally is removed automatically upon payment of the tax.

Property taxes are the largest own-source of revenue for counties cities townships school districts and special districts which are specific-purpose units such as water and sewer authorities. That is they become an encumbrance on the property which the current and future owners must satisfy. In its simplest form the real property tax is calculated by multiplying the value of land and buildings by the tax rate.

Part two covering the school tax system will show how a well-intended 1982 US. The tax structure for this taxing group is straightforward and easily understood. How Property Taxes Are Calculated Assessing Property Tax.

Supreme Court decision Plyler v. Tax on a property is assessed primarily by taking into consideration sales prices of similar properties in the same area. Plus this cap is on a.

Property taxes are determined by multiplying the propertys assessed value by the mill rate. Well Ill tell you everything you need to know to start making money with tax-defaulted properties. School districts rely quite heavily on property taxes collecting 212 billion in 2017 which was 83 percent of their own-source general revenue.

Property taxes are calculated using the value of the property. The first part of property taxes is determining the value of your property. Are you wondering how do property tax auctions work.

Authorities revalue properties regularly. If you buy a. It would be a lot of work for the assessor to visit every property in an area.

Property taxes generally attach to the property. Property taxes are semi-annual or annual taxes levied against the assessed value of real estate. Understand how property tax works who levies it how to lower yours and much more.

This attachment or lien generally happens automatically without further action of the taxing authority.

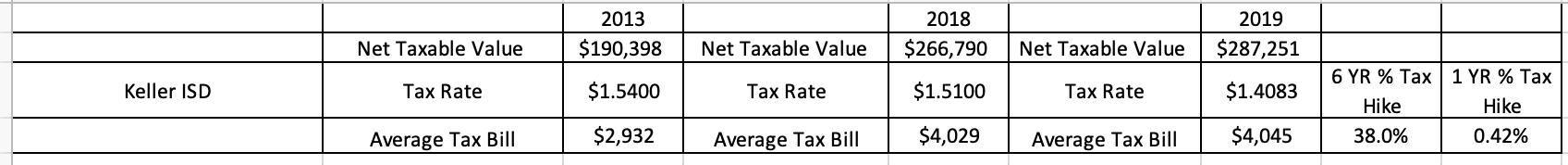

Commentary How Property Taxes Work Texas Scorecard

Commentary How Property Taxes Work Texas Scorecard

Understanding Property Taxes J Joseph

/howhomevalueisassessed-f1f98b53f65943d8bda8304d43175cfa.png) Learn How Property Taxes Are Calculated

Learn How Property Taxes Are Calculated

How Property Taxes Work By Oconnorassociate Issuu

How Property Taxes Work By Oconnorassociate Issuu

Blog How Property Taxes Work And Why Taxpayers Continue To Hurt Texas Scorecard

Blog How Property Taxes Work And Why Taxpayers Continue To Hurt Texas Scorecard

January 2014 Anne Rossley Real Estate

How Do State And Local Property Taxes Work Tax Policy Center

How Do State And Local Property Taxes Work Tax Policy Center

Https Itep Org Wp Content Uploads Pb46proptax Pdf

Understanding Property Taxes In The Ann Arbor Area

Understanding Property Taxes In The Ann Arbor Area

Property Tax 101 How Property Taxes Work In Texas Youtube

Property Tax 101 How Property Taxes Work In Texas Youtube

How Do Property Taxes Work Rob Costabile

How Do Property Taxes Work Rob Costabile

Property Tax Calculator Smartasset

Property Tax Calculator Smartasset

Comments

Post a Comment