Federal Vs Private Student Loans

Interest on these loans has. While federal student loans and private loans have more in common than not there are some key differences to know about.

Federal Versus Private Student Loans Infographic Center For Responsible Lending

Federal Versus Private Student Loans Infographic Center For Responsible Lending

The same is true if you have an existing banking relationship and can negotiate lower.

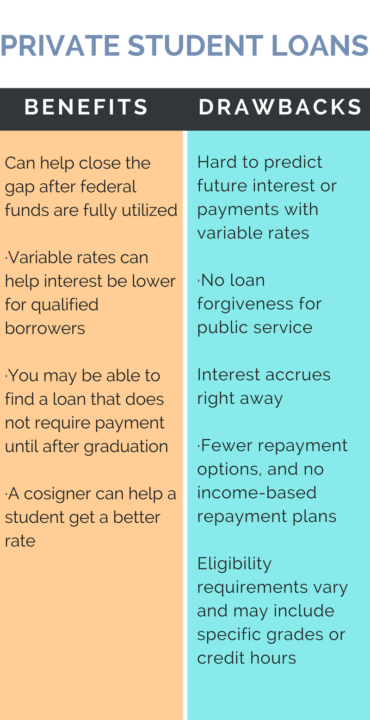

Federal vs private student loans. By contrast fixed rates on private loans for under. Whether you choose federal or private student loans to help pay for your schooling you must pay back the money you borrow regardless if you graduate or not. Private student loans The basic difference between federal and private student loans is that federal student loans are offered by the government while private student loans are offered.

Private student loans are available with fixed or variable interest rates. Here are the biggest differences between federal student loans vs. Private student loans generally only have lower interest rates if the borrower is well-off.

The Master Promissory Note MPN is the contract signed by students that sets out the loan terms and requirements. Federal student loans have origination fees. Approval for federal loans is based on financial need and your FAFSA application results.

Signing a Master Promissory Note is required to get any federal student loan. Theyre there for you when you cant quite scrape together enough federal loans and scholarship money to pay for your dorm room. Make sure you know and understand the interest rates how to repay the loans and when you should.

Taking out a loan is a legal agreement between you and the loan lender so make sure you understand what you are signing and agreeing to. They tend to have lower interest rates and more flexible repayment plans than private loans. What type of loan youll be able to borrow will depend on several factors including your needs year in school income and how much youve already borrowed.

Read on to learn more. They also have fewer restrictions as to how you can use your money using it for postgraduate expenses such as bar preparation courses or. If you must take out student loans look at federal student loans first.

Federal student loans are administered by the US. OK now that weve ripped that Band-Aid off. A federal student loan only becomes due six months after you graduate.

Broadly there are two types of student loans. Private Student Loan Contracts. Once signed students usually will not be required to sign a second MPN.

With private student loans you can begin repayment even when youre still in college although it is allowable to defer payment until after you graduate. Federal student loans come from the US. Every student gets the same competitive rate they come with more flexible repayment plans and they offer more options for deferment forbearance and forgiveness.

In general federal student loans provide additional flexibility in several areas than private student loans. Private student loans were going to have to do a little bubble bursting first. Compared with private student loans federal student loans have a few disadvantages.

Private student loans come from private institutions like banks credit unions and online lenders. However if you need a higher loan amount private loans might be the right option for you. Federal loans are more often than not a better option for student borrowers.

Private student loans are issued by various lenders and come with competitive fixed or variable interest rates depending on market trends. Four key differences between federal and private student loans. Federal student loans are issued by the government and come with a fixed interest rate.

Most schools the federal government and even private lenders recommend taking out federal over private student loans. Federal vs Private Student loans which is better. They exist to make a profit not because theyre dying to see you walk across that stage in your cap and gown.

Before we dive into the differences in federal vs. A borrowers creditworthiness and the underwriting policies of the lender may influence the actual rate. Borrowers dont need a credit check to be considered except for the Federal PLUS Loans for parents and graduate students.

Federal direct student loans have an. Private student loan lenders are out to make money. In general students or.

Private student loans are often designed to step in and cover expenses when federal student loans fall short. Federal vs Private Student Loans. For everyone else the rates are likely to be higher and the repayment options are far more strict.

For the 2020-21 school year rates on federal subsidized and unsubsidized student loans for undergraduates is 275. Private student loans are made by private lenders such as banks or credit unions while federal student loans are made by the federal government. For many students federal loans are therefore the better choice.

The government issues federal student loans according to terms set by Congress. Both types of loans offer students temporary funding assistance to pay for the college or university theyll be attending. Typically you are given up to 25 years to pay off your full loan balance although 10-year repayment plans also exist.

Federal student loans offer flexible repayment terms and fixed interest rates that are typically lower than those offered by private student lenders. Congress assigns fixed interest rates to federal student loans.

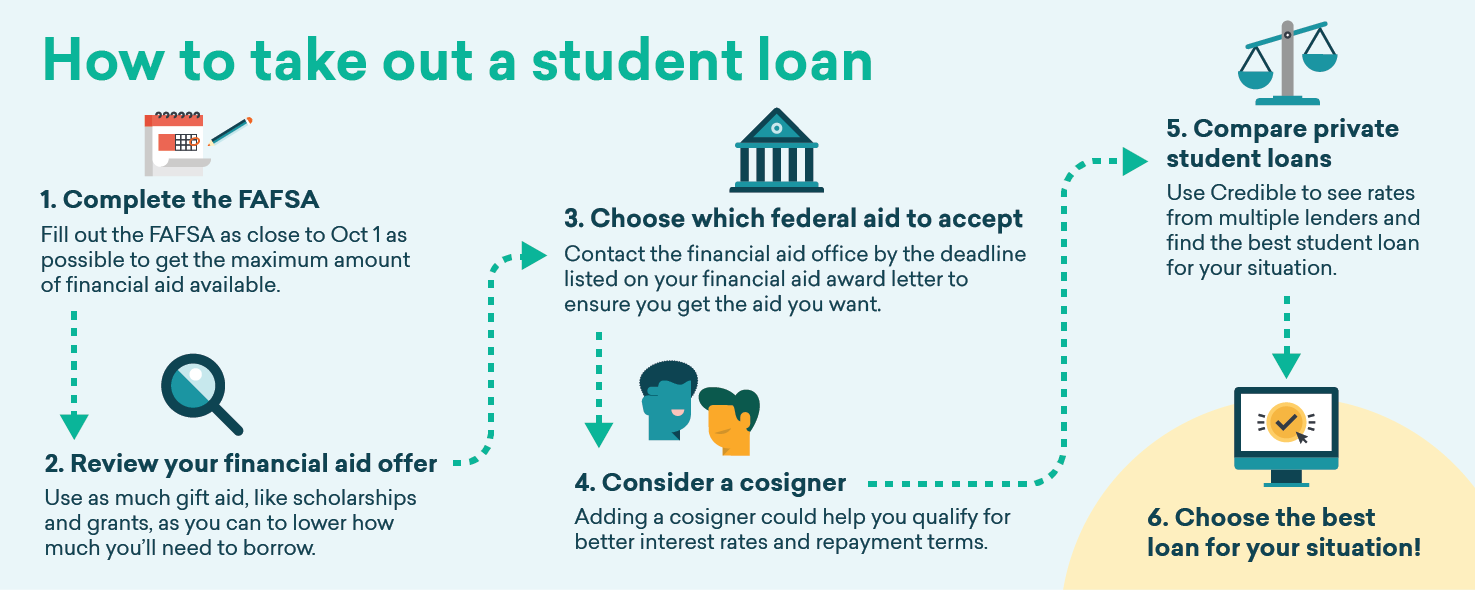

How To Take Out A Student Loan Credible

How To Take Out A Student Loan Credible

Federal Loans Vs Private Loans Financial Aid Office Siu

Federal Loans Vs Private Loans Financial Aid Office Siu

Federal Vs Private Student Loans College Ave

Federal Vs Private Student Loans College Ave

Chapter 1 What Are The Differences Between Federal And Private Student Loans Moneycounts A Penn State Financial Literacy Series

Difference Between Getting Federal Student Loans And Private Student Loans Simple Loan

Difference Between Getting Federal Student Loans And Private Student Loans Simple Loan

Student Loans Explained Wtfinance Mintlife Blog

Student Loans Explained Wtfinance Mintlife Blog

Federal Vs Private Student Loans Youtube

Federal Vs Private Student Loans Youtube

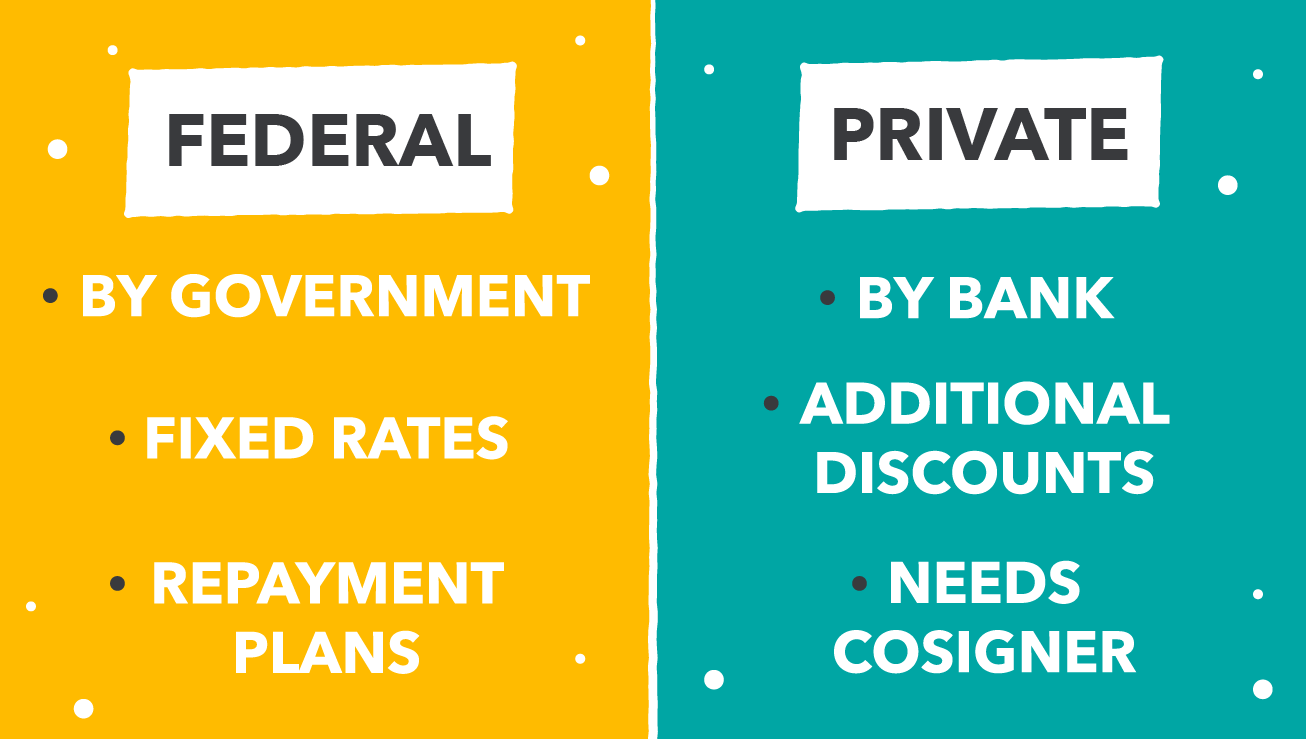

Federal Vs Private Student Loans

Federal Vs Private Student Loans

Federal And Private Student Loans From A To Z Road2college

Federal And Private Student Loans From A To Z Road2college

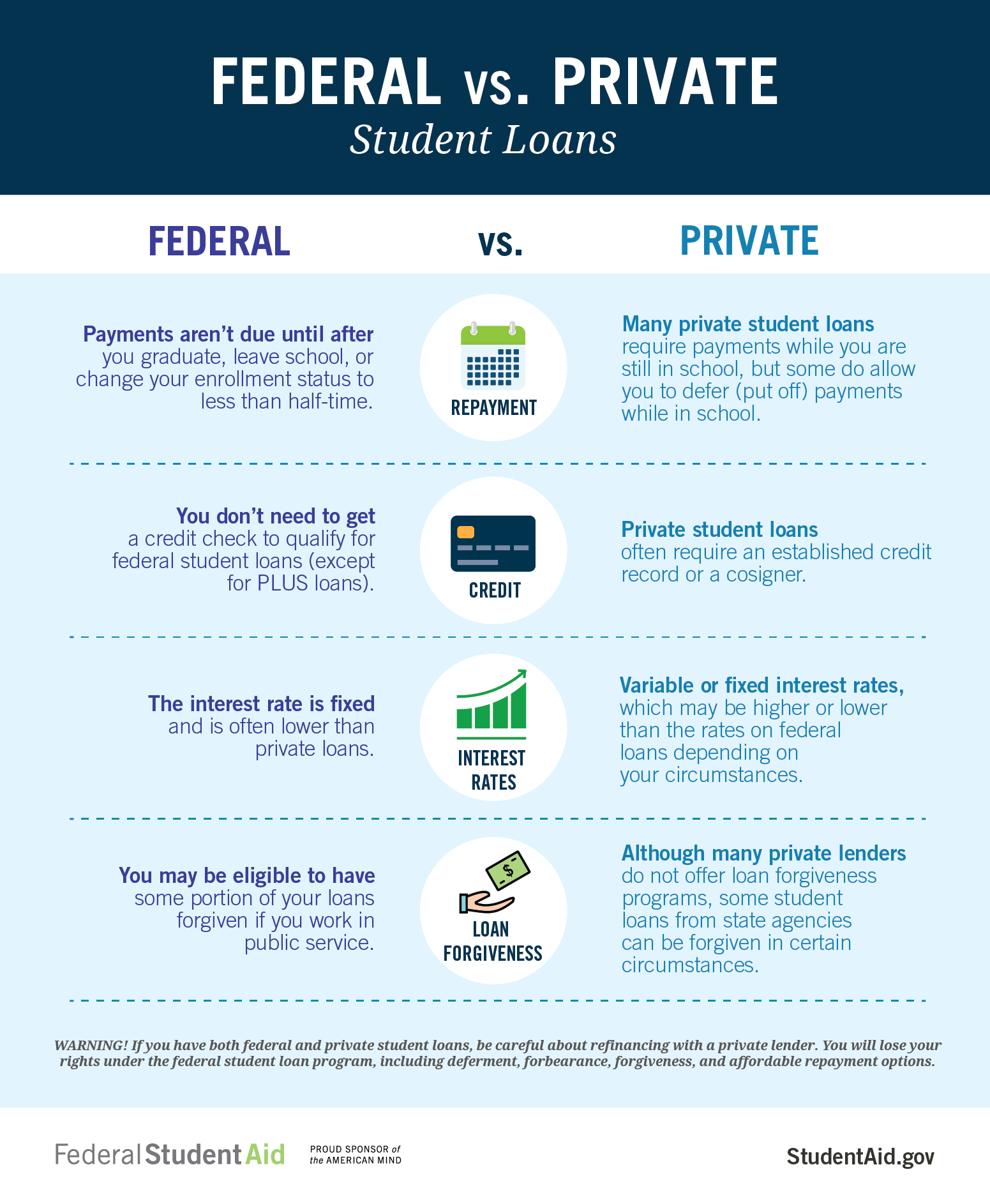

Federal Student Aid On Twitter There Are Pros And Cons To Federal And Private Student Loans Learn More About The Differences Here Https T Co Zfs6dnj96s Https T Co Qduyw9k0su

Federal Student Aid On Twitter There Are Pros And Cons To Federal And Private Student Loans Learn More About The Differences Here Https T Co Zfs6dnj96s Https T Co Qduyw9k0su

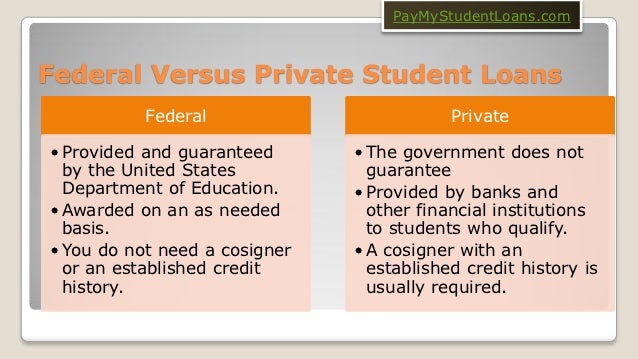

Federal Student Loans Vs Private Student Loans

Federal Student Loans Vs Private Student Loans

Student Loans 101 It S A Money Thing

Student Loans 101 It S A Money Thing

Federal Vs Private Student Loans Key Differences Debt Com

Federal Vs Private Student Loans Key Differences Debt Com

Comments

Post a Comment