Inheritance Tax Usa

The standard Inheritance Tax rate is 40. Inheritance tax is a state tax on assets inherited from someone who died.

Uk And Ireland Impose Highest Taxes On Inheritance Of All Major Economies Uhy Internationaluhy International

COVID-19 Relief for Estate and Gift Learn about the COVID-19 relief provisions for Estate Gift.

Inheritance tax usa. The amount of inheritance tax that will be charged on the assets will depend on where the deceased. US estate and gift tax rules for resident and nonresident aliens 9 Generation-skipping transfer tax GST tax if applicable is imposed in addition to estate or gift taxes. Inheritance tax is charged at 40 on the amount you.

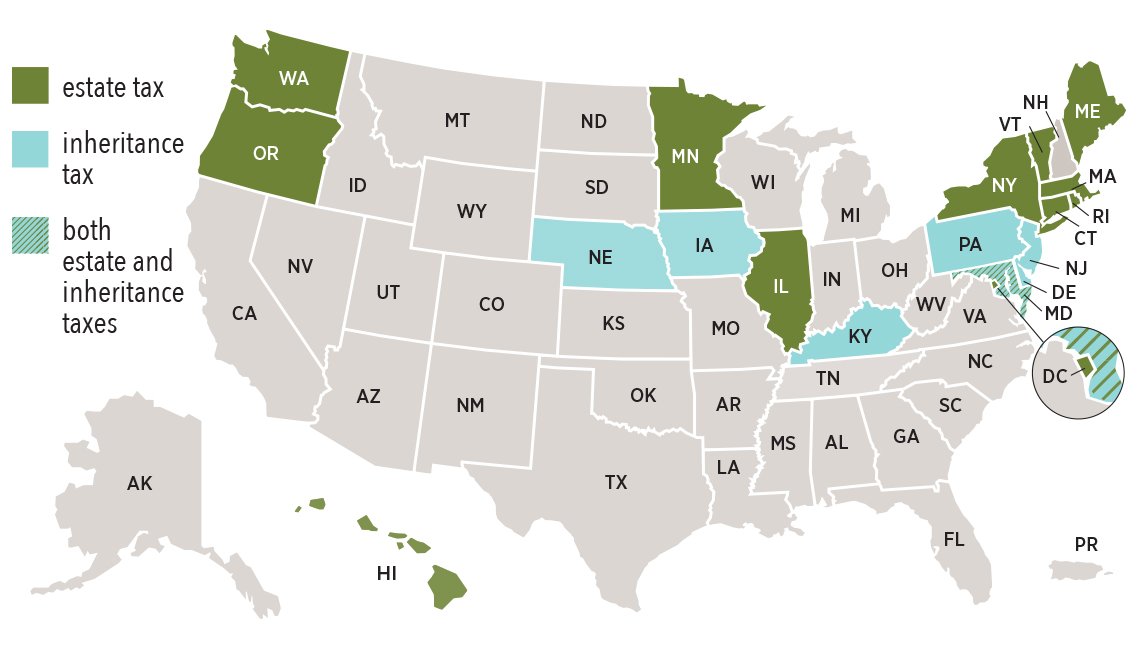

Iowa Kentucky Maryland Nebraska New Jersey and. What Is Inheritance Tax. The person who inherits the assets pays the inheritance tax.

An inheritance tax requires beneficiaries to pay taxes on assets and properties theyve inherited from someone who has died. Estate tax of 10 percent to 16 percent on estates above 1 million. Continuing from above since the United States cannot tax the inheritance they are going to do what they can to force the recipient of the money Brian to report the money to the United States government.

It is relatively simple and straightforward. It consists of an accounting of everything you own or have certain interests in at the date of death. Example Your estate is worth 500000 and your tax-free threshold is.

2 And finally an estate tax is a tax on the value of the decedents property. Thats because federal law doesnt charge any inheritance. INHERITANCE TAX IN THE USA In contrast the US federal government does not impose an inheritance tax.

Its paid by the estate and not the heirs although it could reduce the value of the inheritance. There is no federal inheritance tax The first rule is simple. Its only charged on the part of your estate thats above the threshold.

An inheritance tax is a tax on the property you receive from the decedent. Estate tax of 08 percent to 16 percent on estates above 16 million. The estate tax is a tax on your right to transfer property at your death.

Inheritance tax of up to 16 percent. It is imposed on US taxable gifts and bequests made to or for the benefit of persons who are two or more generations below that of the donor such as a grandchild. Estate tax of 306 percent to 16 percent for estates above 59 million.

Rather just a handful of states impose the tax. The federal estate tax also known as the inheritance tax is primarily paid by the estates of multi-millionaires and billionaires before their assets are passed to their heirs. If you receive property in an inheritance you wont owe any federal tax.

Why do they Care. Sometimes an inheritance tax is used interchangeably with the term estate tax Both are forms of so-called death taxes but in fact theyre two different types of taxes. Since 6 April 2017 domicile is determined similarly for Income Tax and Inheritance Tax purposes.

1 A capital gains tax is a tax on the proceeds that come from the sale of property you may have received. It is also imposed on gifts made to donees who. We discuss inheritance tax and how it might affect you when you purchase property in the USA.

As of 2018 only 6 states Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania impose an inheritance tax in. What Is an Inheritance Tax. Inheritance tax is a state tax on a percentage of the value of a deceased persons estate thats paid by the inheritor of the estate.

Inheritance tax of up to 15 percent. The fair market value of these items is used not necessarily what you paid for them or what their values were when you acquired them. However since 6 April 2017 for both Income Tax and Inheritance Tax a non-dom will become deemed-dom once they have been resident in the UK for at least 15 out of the last 20 tax.

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to Form 706 PDF PDF. The Estate Tax is a tax on your right to transfer property at your death. Under General Law it is possible to keep your domicile of origin in the US and it is based on your intention to return to the US.

Currently the gift and estate tax exemption is.

Does Your State Have An Estate Or Inheritance Tax

Does Your State Have An Estate Or Inheritance Tax

17 States With Estate Taxes Or Inheritance Taxes

17 States With Estate Taxes Or Inheritance Taxes

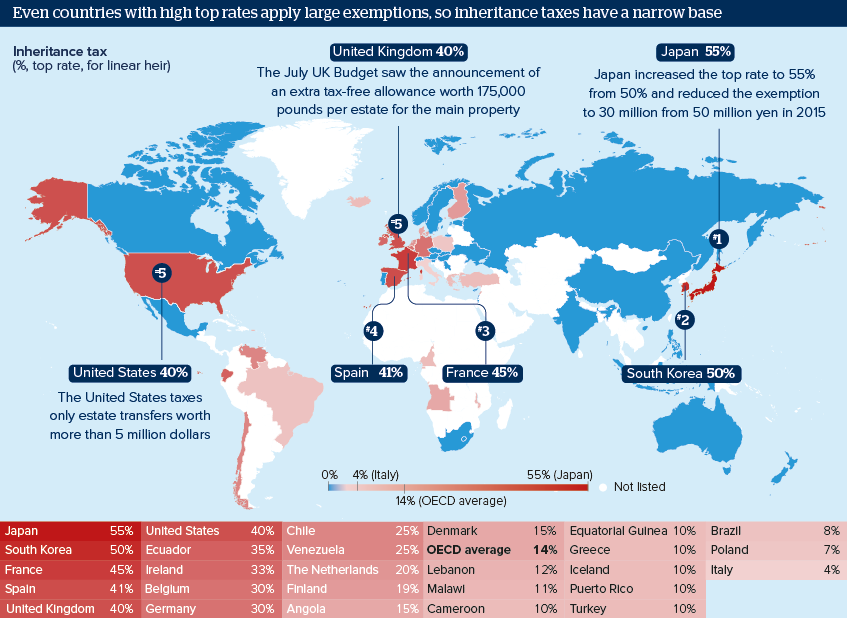

Inheritance Tax Is Poor Answer To Raising Revenues Oxford Analytica Daily Brief

Inheritance Tax Is Poor Answer To Raising Revenues Oxford Analytica Daily Brief

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

Opportunities And Pitfalls For Foreign Inheritances And Beneficiaries Advisor S Edge

Taxing Inheritances Is Falling Out Of Favour The Economist

Taxing Inheritances Is Falling Out Of Favour The Economist

Estate Tax In The United States Wikipedia

Estate Tax In The United States Wikipedia

Estate Tax In The United States Wikipedia

Estate Tax In The United States Wikipedia

State Estate And Inheritance Taxes In 2014 Tax Foundation

State Estate And Inheritance Taxes In 2014 Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Does Your State Have An Estate Or Inheritance Tax Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

Estate And Inheritance Taxes Around The World Tax Foundation

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

How Do The Estate Gift And Generation Skipping Transfer Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Be Strategic Where You Die

States With No Estate Tax Or Inheritance Tax Be Strategic Where You Die

Comments

Post a Comment