Federal Tax Tables 2020

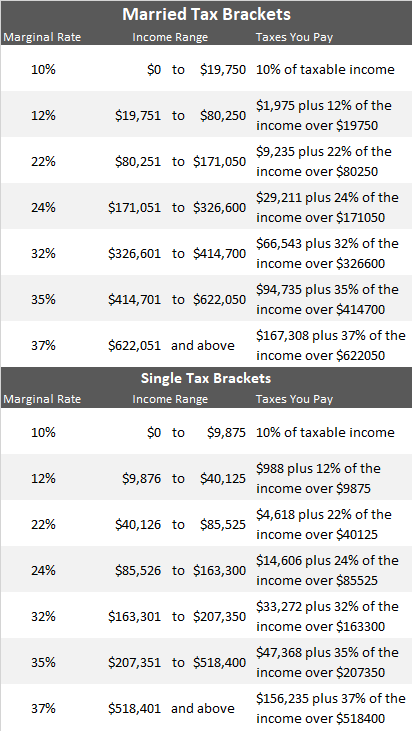

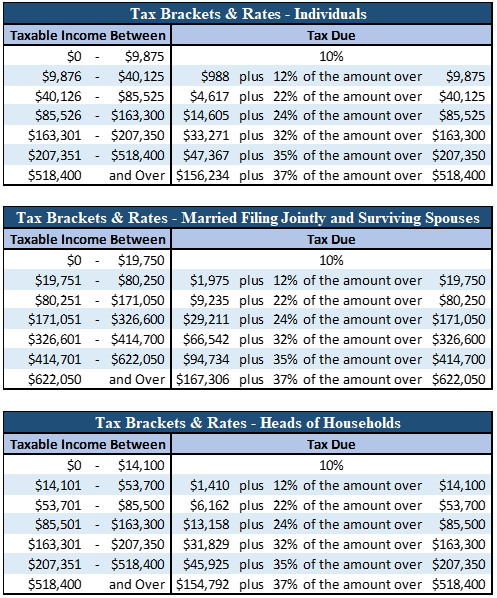

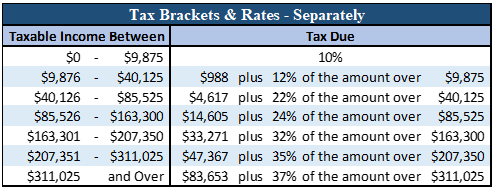

10 12 22 24 32 35 and 37. The Internal Revenue Service adjusted the tax tables against inflation for 2019 taxes that are due on April 15 2020.

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

Irs 2020 Tax Tables Deductions Exemptions Purposeful Finance

If you compute payroll manually your employee has submitted a Form W-4 for 2020 or later and you prefer to use the Wage Bracket method use the worksheet below and the Wage Bracket Method tables that follow to figure federal income tax withholding.

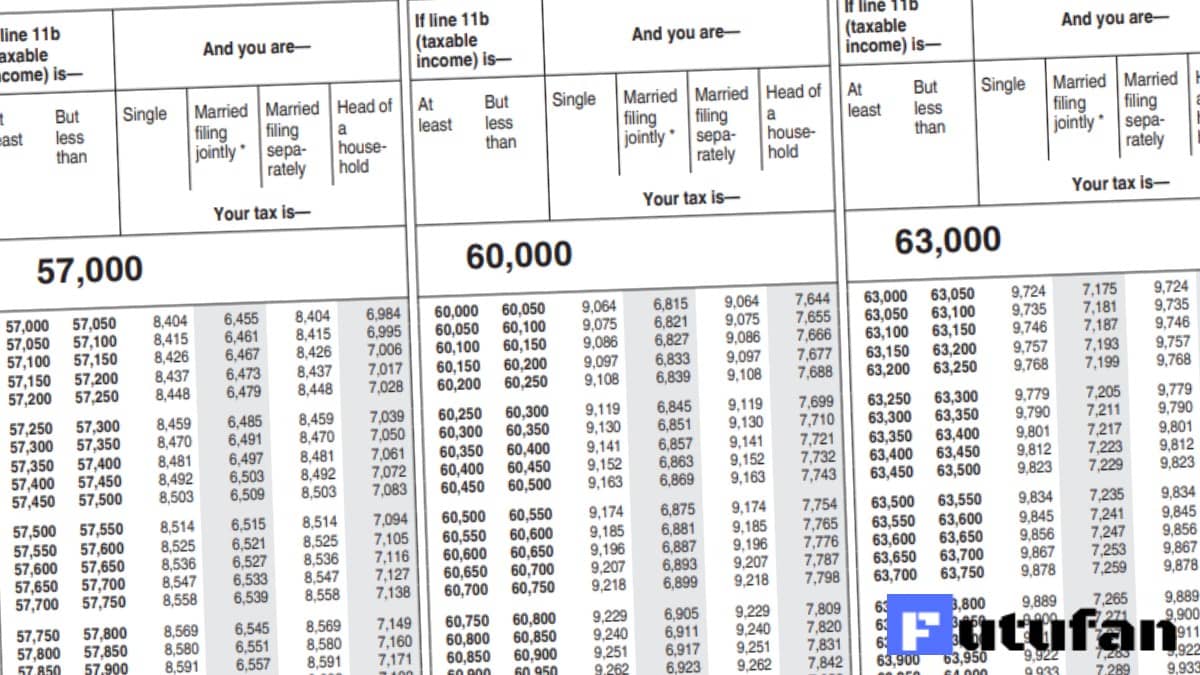

Federal tax tables 2020. The Wage Bracket Method tables cover only up to approximately 100000 in annual wages. For 2019 W-4 Deductions per dependent. Your taxis 25200 25250 25300 25350 2830 2836 2842 2848.

Instructions for Schedule 2. Disclosure Privacy Act and Paperwork Reduction Act Notice. There are seven federal tax brackets for the 2020 tax year.

If Taxable Income. Married Individuals Filling Joint Returns. 10 12 22 24 32 35 and 37.

For 2018 and previous tax years you can find the federal tax rates on Schedule 1. You will find the provincial or territorial tax rates on Form 428 for the respective province or territory all except Quebec. 10 tax rate up to 9875 for singles up to 19750 for joint filers 12 tax rate up to 40125.

For 2019 2020 and later tax years you can find the federal tax rates on the Income Tax and Benefit Return. The tables include federal withholding for year 2020 income tax FICA tax Medicare tax and FUTA taxes. At Least But Less Than SingleMarried ling jointly Married ling sepa-rately Head of a house-hold.

See the instructions for line 16 to see if you must use the Tax Table below to figure your tax. To find the Quebec provincial tax rates go to Income tax return schedules and guide Revenu. 430000 if the Form W-4 is from 2019 or earlier or if the Form W-4 is from 2020 or later and the box.

For 2020 there are seven bracket of federal tax 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent which after that will be matched with your filing status and also taxable income as a worker. Use T4032 Payroll Deductions Tables to calculate the Federal Provincial and Territorial Income Tax Deductions the Employment Insurance premiums and the Canada Pension Plan contributions. What are the 2020 tax brackets.

Your bracket depends on your taxable income and. You might check the withholding tax in 2020 on the adhering to tables. Major Categories of Federal Income and Outlays for Fiscal Year 2019.

For 2020 there are 7 bracket of federal tax 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent which after that will be matched with your filing status and also taxable income as a worker. 8 rijen The tax rates for 2020 are. There are seven tax rates ranging from 10 to 37 as of 2020.

While the marginal rates remain the same as 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. The 2020 federal income tax brackets on ordinary income. 25250 25300 25350 25400 2632 2638 2644 2650 2830 2836 2842 2848 2745 2751 2757.

Explore 2020 federal income tax brackets and federal income tax rates. They are not the numbers and tables that youll use to prepare your 2019 tax returns in 2020 youll find them here. Instructions for Schedule 3.

Its important to note you only have to pay the tax rate on the amount your taxable income falls into for each tax bracket. 7 rijen 2020 Federal Income Tax Rates. This is whats known as progressive taxation and can confuse a lot of people but.

Its important to remember. The 2020 Tax Tables and 2020 Tax Brackets are provided below for each Province Territory along with the Federal Tax Brackets for 2020. Alberta Tax Tables 2020 British Columbia Tax Tables 2020 Manitoba Tax Tables 2020 New Brunswick Tax Tables 2020 Newfoundland and Labrador Tax Tables 2020.

These are the numbers for the tax year 2020 beginning January 1 2020. Instructions for Schedule 1. 2020 Provicial and Territorial Tax Tables.

:max_bytes(150000):strip_icc()/2020IRSTaxTablesScreenShot-16679838387b47b492ac296463926902.jpg) Where To Find And How To Read 1040 Tax Tables

Where To Find And How To Read 1040 Tax Tables

Here S A Breakdown Of The New Income Tax Changes

Here S A Breakdown Of The New Income Tax Changes

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

Your Guide To 2020 Federal Tax Brackets And Rates Incfile

Your Guide To 2020 Federal Tax Brackets And Rates Incfile

2021 W 4 Guide How To Fill Out A W 4 This Year Gusto

2021 W 4 Guide How To Fill Out A W 4 This Year Gusto

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

2020 Tax Brackets Rates Released By Irs What Am I Paying In Taxes This Year Fortune

Irs Tax Tables 2020 2021 Federal Tax Brackets

Irs Tax Tables 2020 2021 Federal Tax Brackets

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg) What Tax Breaks Are Afforded To A Qualifying Widow

What Tax Breaks Are Afforded To A Qualifying Widow

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Tax Brackets For Self Employed Individuals In 2020 Shared Economy Tax

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

Comments

Post a Comment