How Much Tax Do You Pay When You Sell Stock

Shares and investments you may need to pay tax on include. Section 83b Election Example.

Save Ltcg Tax On Stocks Business News

Save Ltcg Tax On Stocks Business News

Here are 5 tax planning ideas to reduce or eliminate CGT for long-term capital gains which are net profits on investments held over a year plus their pros and cons.

How much tax do you pay when you sell stock. You get 300000 in either case but in the second scenario you wont have to give any of it to the IRS. If you sell a stock for less than what you paid for it. Also note that brokerage fees are included in your purchases which means that if I want to buy a 100 share but the brokerage fee is.

Nevertheless it seems that many people who buy shares with plans to sell them dont pay tax on their gains - and many do the same with property. In that case youll only pay 15 or 150 in taxes because thats the capital gains tax rate youll be subject to. As of 2012 the ordinary income tax rates go as high as 35 percent so if youve held the stock for close to year it makes sense to hold it a few more days so your gains can be taxed at the lower long-term capital gains rates.

The situation is much different because of that step-up in basis. If youre a retiree or in a lower tax bracket less than 75900 for married. Capital gains dont just apply to stocks.

However your first paragraph rather counts you out of that group. As long as they are not audited they get away with it. If you later sell the home for 350000 you only pay capital gains taxes on the 50000 difference between the sale price and your stepped-up basis.

Short-term capital gains count as ordinary income for tax purposes which means you pay the same taxes on them as you would any other income. Once you do though youll owe capital gains tax and how much youll pay depends on a number of factors. Stay in a lower tax bracket.

To determine how much you owe in capital gains tax after selling a stock you need to know your basis which is the cost of the stock along with any reinvested dividends and commissions paid. Below youll learn the key factors in determining how much tax youll owe after a stock. This is the tax on any profits from investments such as shares or property.

More than 12 months and you pay tax on 50 of the profit only. If you hold stock securities or funds in a tax-deferred account like an individual retirement arrangement or 401k youll generally be paying taxes on the stocks when you take money out of the. If you sell the home for that amount then you dont have to pay capital gains taxes.

Generally any profit you make on the sale of a stock is taxable at either 0 15 or 20 if you held the shares for more than a year or at your ordinary tax rate if you held the shares for less. So if you gain 30 this financial year but lost 10 in the last financial year you only pay 20 in Capital Gains and immediately use up your 10 offset. Theres no capital gain to be taxed if the propertys fair market value is 300000 as of the date of death and you sell it for 300000.

As for asset transfers you can make these tax-free as well if you receive 100 of the buyers stock. In the 202021 tax year you can earn up to 12300 without paying a penny in CGT to. You may have to pay Capital Gains Tax if you make a profit gain when you sell or dispose of shares or other investments.

If you sell for a gain you will have to pay either short-term capital gains short term being less than one year or long term capital gains if youve held the stock for a year or longer. For annotated diagrams showing how to report this sale on your tax return see Reporting Company Stock Sales in the Tax Center. Two years after the last shares vest you sell all of the stock.

You can earn a capital gain on pretty much any asset you sell for more than you paid for it. When the time comes to sell on your stocks and shares you may also incur capital gains tax CGT too. For example if you purchased the stock 10 years ago for 1000 and you reinvested dividends each year totaling 200 your total basis is 1200.

Otherwise you can get away with a tax-free transaction by simply keeping it as an exchange of non-cash assets. However in many cases you wont have to pay capital gains tax on a profit from a home sale. The only time you will be taxed is if the buyer gave you actual cash for your stock or assets.

5 ways to avoid paying Capital Gains Tax when you sell your stock. Your capital gain is 92000 200000 minus 108000. Selling a losing stock.

Less than 12 months and you pay tax on the entire profit. And the fact that you are a casual player wont let you off the hook. The amount of tax you pay is dependent on the marginal tax.

The stock price at sale is at 50 200000 for the 4000 shares. Shares and capital gains tax. You pay tax on either all your profit or half 50 your profit depending on how long you held the shares.

If youve sold for a loss there is no tax to pay. We all get annual personal allowances for CGT too.

My Company Hit It Big What Do I Do With All This Stock Flow Financial Planning

/Taxes-b5743df0be814fe9a34c2f2255f47fb2.jpg) Will I Have To Pay Taxes On Any Stocks I Own

Will I Have To Pay Taxes On Any Stocks I Own

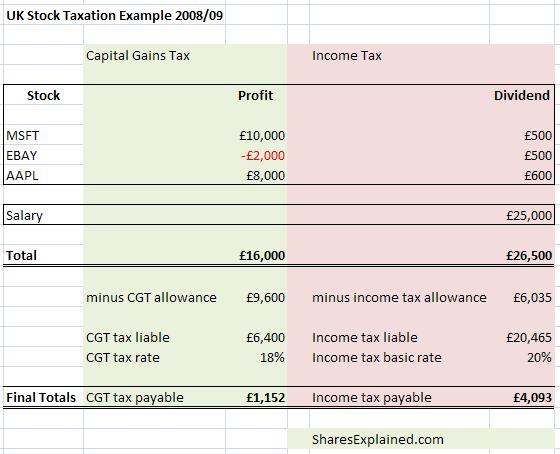

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

Taxation Rules On Stocks And Shares Sharesexplained Comshares Explained

What Taxes Do I Pay On Stock Gains Acorns

What Taxes Do I Pay On Stock Gains Acorns

What Will Be Your Tax Liability If You Sell Shares Traded In The Us Stock Market The Economic Times

What Will Be Your Tax Liability If You Sell Shares Traded In The Us Stock Market The Economic Times

/170042048-F-56a634653df78cf7728bd37a.jpg) How Will Selling My Stocks Affect My Taxes

How Will Selling My Stocks Affect My Taxes

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-3305824_v3-b4d960afdf8f427192af57be51e4adc1.png) How Will Selling My Stocks Affect My Taxes

How Will Selling My Stocks Affect My Taxes

/stock-trading-101-358115_V3-37f97e70c6df4b748ba5cb19942ef6a9.gif) A Beginner S Guide To Online Stock Trading

A Beginner S Guide To Online Stock Trading

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

Taxes On Stocks What You Have To Pay How To Pay Less Nerdwallet

This Could Be The Most Important Tax Rule You Follow The Motley Fool

This Could Be The Most Important Tax Rule You Follow The Motley Fool

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

When Should You Sell Your Espp Shares Myra Personal Finance For Immigrants

When Should You Sell Your Espp Shares Myra Personal Finance For Immigrants

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

Comments

Post a Comment